USD/JPY, EUR/JPY and GBP/JPY - Latest Retail Sentiment Analysis

Learn how to trade USD/JPY with our complimentary guide

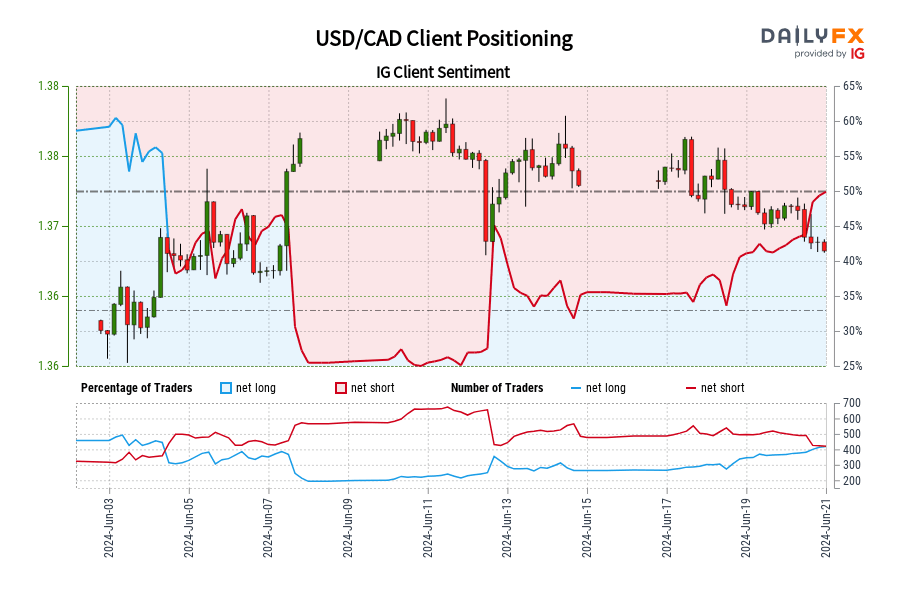

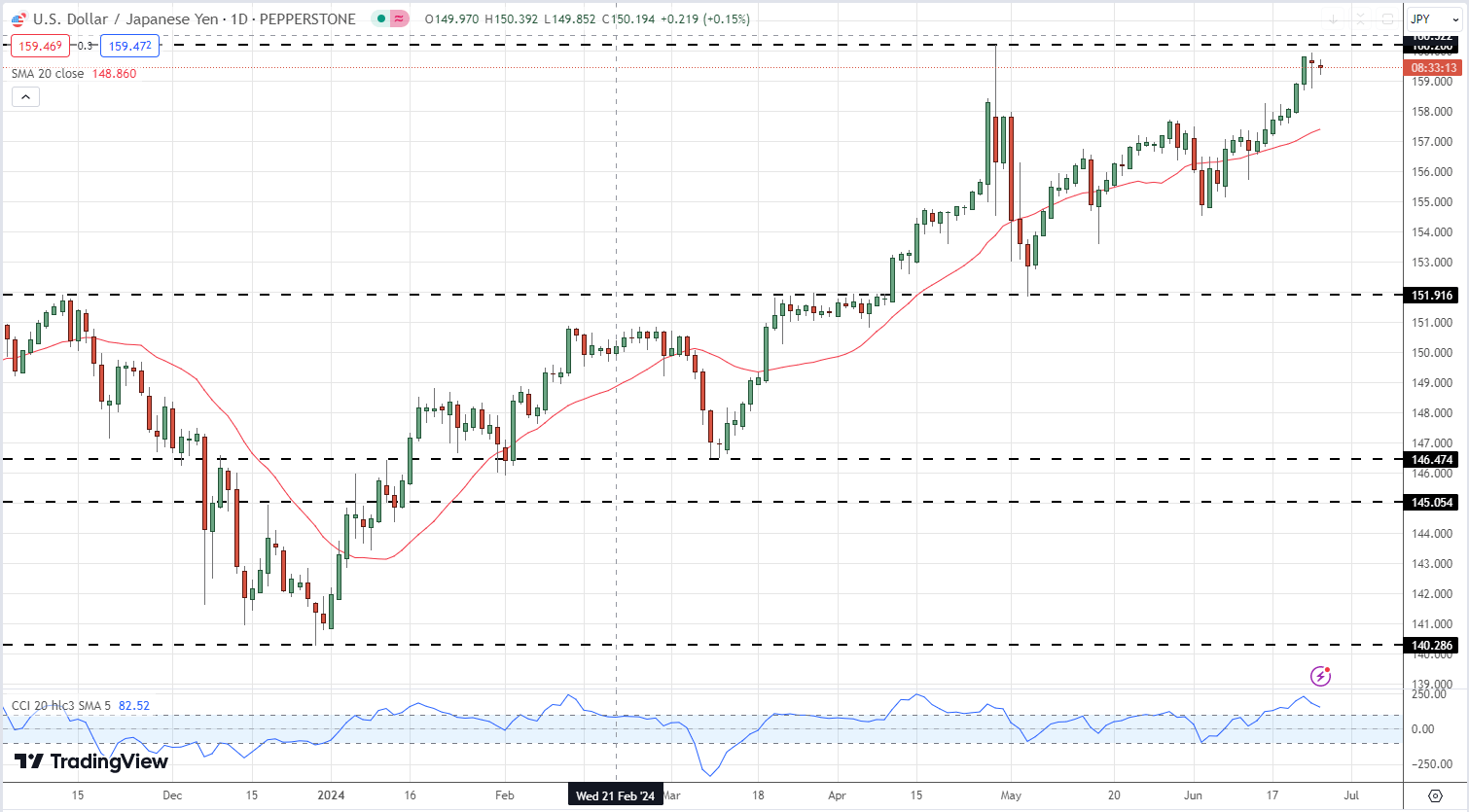

USD/JPY – Decoding Market Sentiment

Latest retail trader data reveals a stark USD/JPY market divide, with only 16.98% of traders maintaining net-long positions. This creates a significant short-to-long ratio of 4.89 to 1. Net-long traders have increased by 1.36% since yesterday but decreased by 10.94% over the week. Net-short traders show growth of 0.51% daily and 22.33% weekly.

Our contrarian analysis suggests continued USD/JPY price gains. However, the dynamic nature of current positioning complicates the picture, leading to a mixed USD/JPY trading outlook.

USD/JPY Daily Price Chart

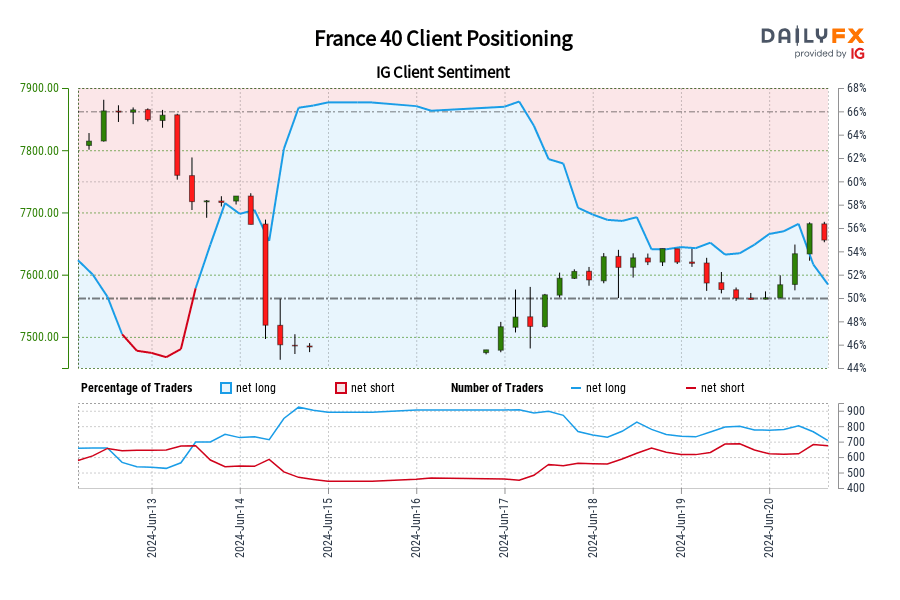

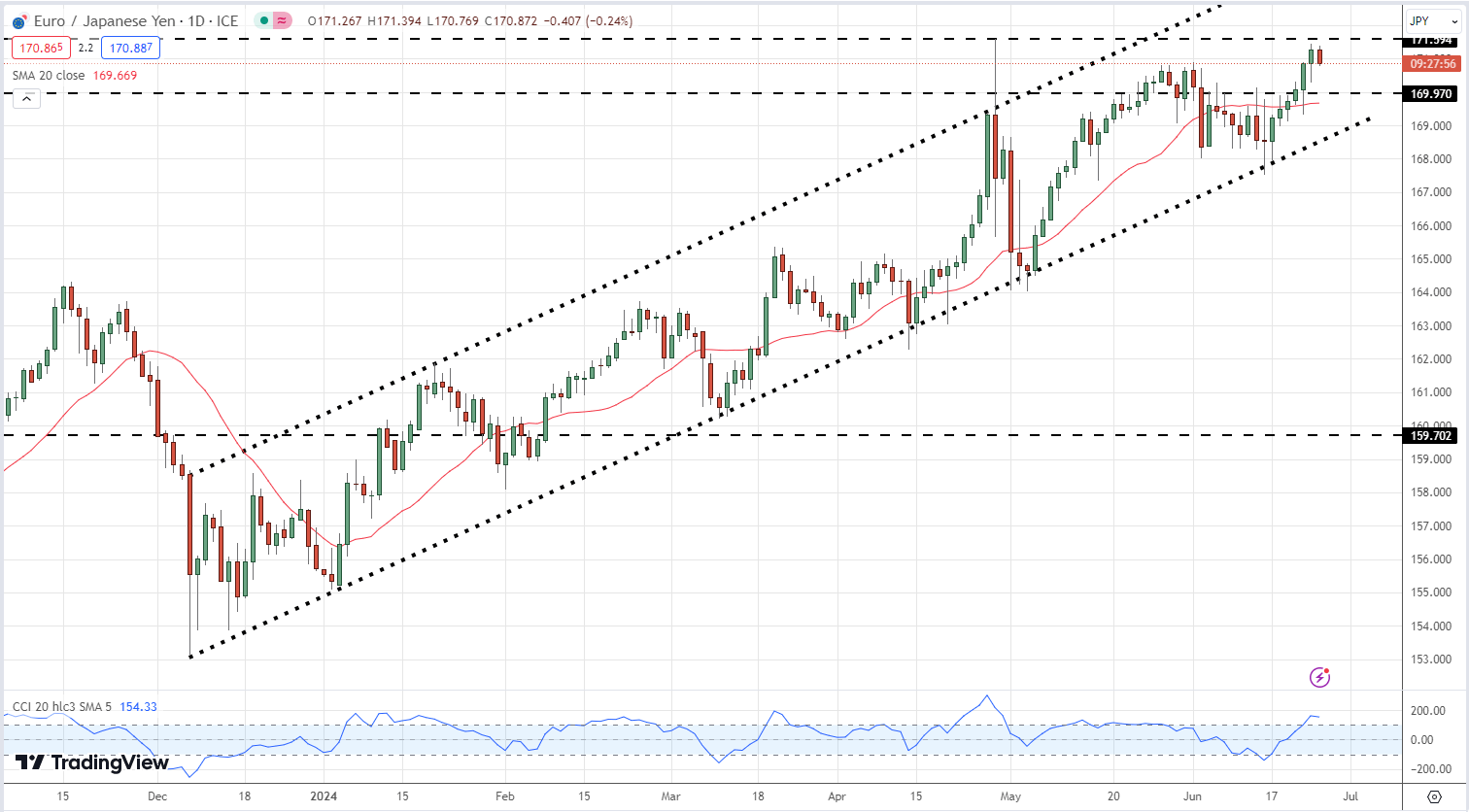

EUR/JPY – Bullish Contrarian Bias

Latest data shows a pronounced shift in EUR/JPY retail trader positions. A mere 16.49% of traders hold net-long positions, resulting in a 5.07 to 1 short-to-long ratio. Net-long traders have decreased by 13.75% since yesterday and 31.34% over the week. Meanwhile, net-short traders have increased by 8.20% daily and 19.90% weekly.

Our contrarian view on crowd sentiment points towards potential EUR/JPY price gains. The intensifying net-short positioning reinforces our bullish EUR/JPY outlook, suggesting a strong contrarian trading bias.

EUR/JPY Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | -6% | -4% | -5% |

| Weekly | -10% | 4% | 2% |

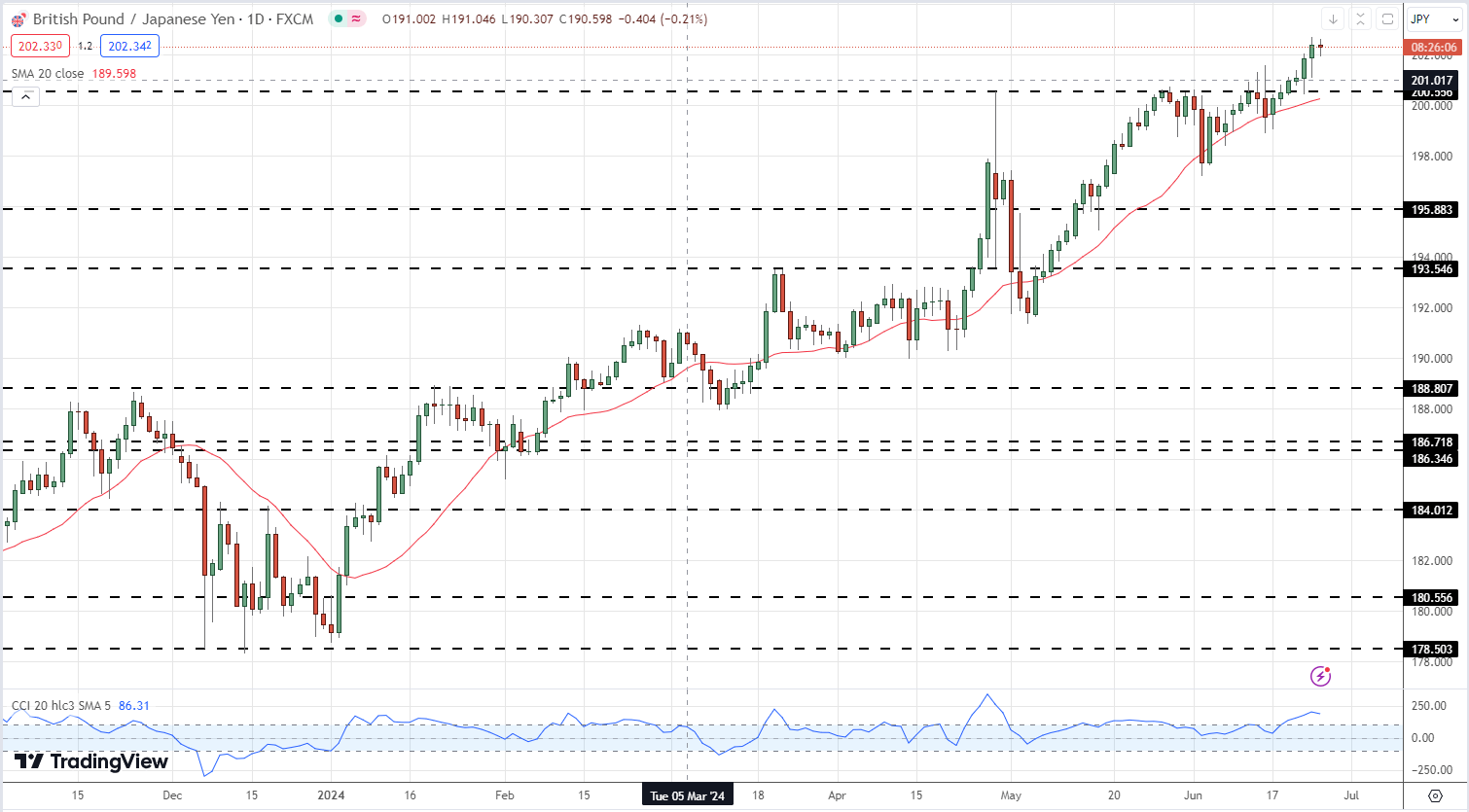

GBP/JPY – Traders Net-Short

Retail trader data shows 22.28% of traders are net-long with the ratio of traders short to long at 3.49 to 1.The number of traders net-long is 3.95% lower than yesterday and 10.99% lower than last week, while the number of traders net-short is 2.60% higher than yesterday and 15.82% higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/JPY-bullish contrarian trading bias

GBP/JPY Daily Price Chart

All charts using TradingView

What is your view on the Japanese Yen– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.