Dow Jones, Nasdaq 100, Fed Credibility Test, Technical Analysis - Talking Points

- Dow Jones and Nasdaq 100 suffering as Fed faces credibility test

- Will a 75-basis point rate hike, or more, restore risk appetite next?

- Both indices are trying to confirm breakouts under key support

The Dow Jones and Nasdaq 100 have been falling since an unexpectedly stronger US inflation report crossed the wires last week. This has resulted in a rapid repricing of Federal Reserve rate hike expectations after the central bank began hinting at a pause in September just weeks ago. The markets now anticipate a whopping 75-basis point bump on Wednesday instead of 50.

It seems like the central bank is facing a credibility test. Normally, a softer-than-expected rate hike would typically trigger a boost in risk appetite and fuel stocks higher. This time might be different. That is because such an outcome could be interpreted as the Fed failing to take adequate steps to meet its average inflation target of 2%, causing markets to lose faith in the central bank doing its job and increasing uncertainty.

As such, the Fed might do whatever it takes to restore confidence this week. A 75bp hike might just be the ticket, or perhaps even more. Last week, the Reserve Bank of Australia unexpectedly delivered a stronger-than-anticipated hike that caught traders off guard. If the Fed pulls off a similar measure and upholds its inflation target, this could bode well for risk appetite in the short run.

Down the road, it remains tough to be fundamentally bullish US equities. The reality is that surging bond yields continue taking away the appeal of owning riskier assets. The stronger CPI report last week means higher rates from the Fed for the time being. But, if the central bank can restore faith and build up confidence, perhaps the pain in stock markets could begin cooling in the not-so-distant future.

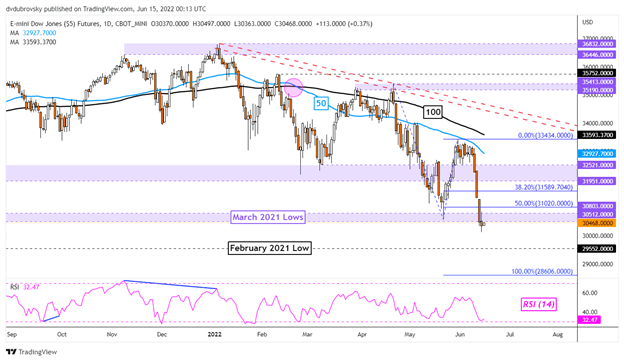

Dow Jones Technical Analysis – Daily Chart

Dow Jones futures have broken and closed under lows from March 2021, effectively taking out the 30512 – 30803 support zone. Confirmation is lacking at this time, so market bears ought to proceed with some caution. The February 2021 low has been exposed at 29552 as the next key support level. In the event of a turn lower, the 50- and 100-day Simple Moving Averages are still pointing lower, offering a bearish bias. These could hold as resistance, reinstating a downside focus.

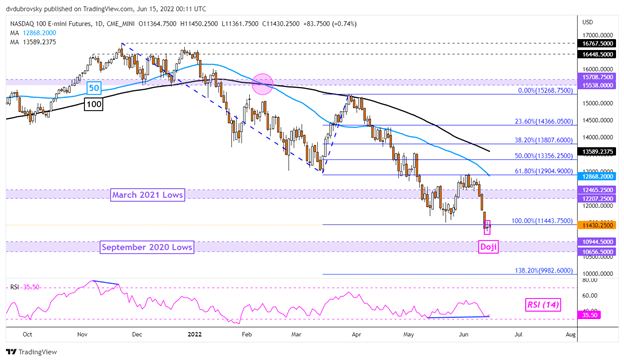

Nasdaq 100 Technical Analysis – Daily Chart

Nasdaq 100 futures close around the lows of this year so far, but prices have left behind a Doji candlestick pattern. This is a sign of indecision amid positive RSI divergence, with the latter showing fading downside momentum. Upside follow-through could spell some optimism ahead, placing the focus on the 50- and 100-day SMAs. These could reinstate the downside focus, maintaining a broader bearish bias.

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter