Silver Price Forecast:

- Silver price action remains within a well-defined range

- Fundamentals may drive the tone for XAG/USD in the short-term

- Fibonacci retracement levels continue to provide support and resistance

Despite a host of major risk events scheduled to be released this week, Silver remains rangebound, with only minor movements so far occurring within a confluent zone, established between key Fibonacci levels.

With both Silver and Gold exhibiting safe-haven appeal, the battle between risk-on and risk-off sentiment continues to play out as the delayed vaccine rollout combined with a decrease in business activity weighs on the highly anticipated Fiscal Stimulus package. Although President-elect Joe Biden’s Democratic party are all in favor of the large $1.9 Trillion deal, the Republicans continue to push for a much smaller deal to be implemented, emphasizing that the vaccine rollout should remain a priority.

Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental Analysis

Meanwhile, this week’s major risk events may create additional volatility, driving price action in either direction. For the USD, apart from Wednesday’s highly anticipated Federal Reserve policy meeting, other major data releases listed on this week’s economic calendar include January’s consumer confidence number (Tomorrow), December’s Durable goods figure (Wednesday), advance estimate for Q4 GDP (Thursday) and the December PCE report (Friday). With the renewal of lockdown measures, all these reports have the potential to influence the demand for XAG/USD and other major commodities.

Silver (XAG/USD) Technical Analysis

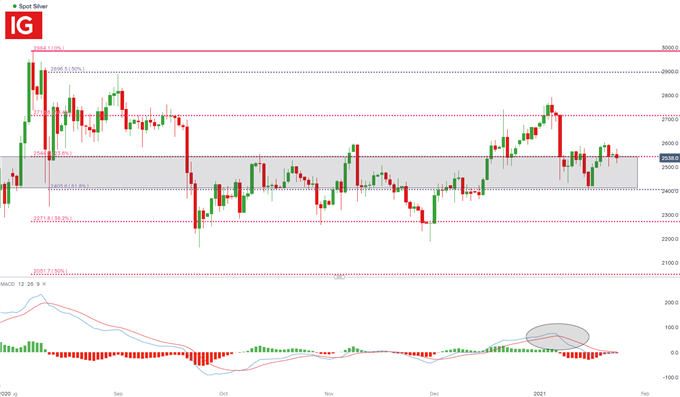

Silver prices continue to honor the Fibonacci retracement levels of both the historical (2008 low – 2011 high) and short-term move (March 2020 low – August 2020 high), forming an area of confluence that continues to hold bulls and bears at bay. Currently, the 23.6% retracement provides support at 2544 while the key psychological level of 2600 holds as resistance. Meanwhile, the Moving Average Convergence/Divergence (MACD) remains on the zero-line, preceding the bearish MACD crossover that occurred earlier this month.

Silver (XAG/USD) Daily Chart

Chart prepared by Tammy Da Costa, IG

For now, support potential remains around the key psychological level of 2500 with the 61.8% Fibonacci retracement level providing additional support at 2409.8

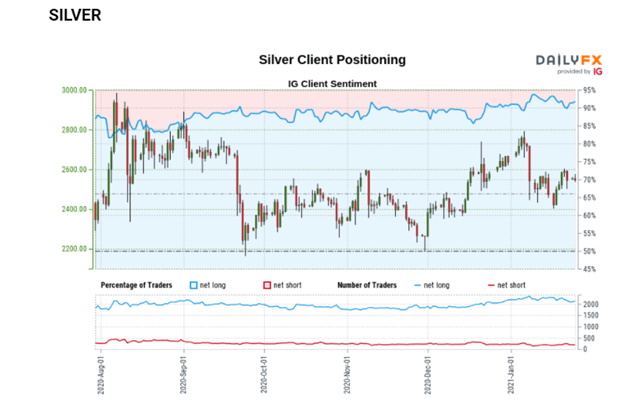

Silver Client Sentiment

| Change in | Longs | Shorts | OI |

| Daily | -7% | 6% | -5% |

| Weekly | 0% | -2% | 0% |

At the time of writing, retail trader data shows 91.71% of traders are net-long with the ratio of traders long to short at 11.06 to 1. The number of traders net-long is 2.06% higher than yesterday and 3.13% lower from last week, while the number of traders net-short is 3.02% lower than yesterday and 7.66% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Silver-bearish contrarian trading bias.

--- Written by Tammy Da Costa, Market Writer for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707