Dow Jones, Crude Oil, US Industrial Production, ASX 200, RBA Minutes – Asia Pacific Indices Briefing

- The Dow Jones declined as the Nasdaq 100 outperformed on Wall Street

- Crude oil prices fell following soft US industrial output, easing inflation woes

- ASX 200 may rise following RBA minutes, capitalizing on mostly rosy sentiment

Monday’s Wall Street Trading Session Recap

Following a fairly disappointing European trading session, market sentiment improved during Monday’s Wall Street period. While the Dow Jones underperformed, the Nasdaq 100 and S&P 500 futures climbed 1.03% and 0.34% respectively. The turnaround in sentiment might have been due to the decline in crude oil prices during North American trading hours.

At one point, WTI climbed about 1.7% after reports crossed the wires that OPEC and its allies, also known as OPEC+, were unable to meet September production targets. Output was about 15% lower than what was expected. Going forward, the oil-producing cartel may face increasing pressure from consumers to increase output. Japan’s Prime Minister, Fumio Kishida, made such remarks earlier in the day.

An unexpected decline in US industrial production, following disappointing Chinese third-quarter GDP data earlier in the day, may have aided the drop in oil prices. These two nations are the top consumers of oil. Signs of their economies slowing could reduce demand expectations. It would likely take more persistent disappointing data to meaningfully impact the trajectory of energy prices however.

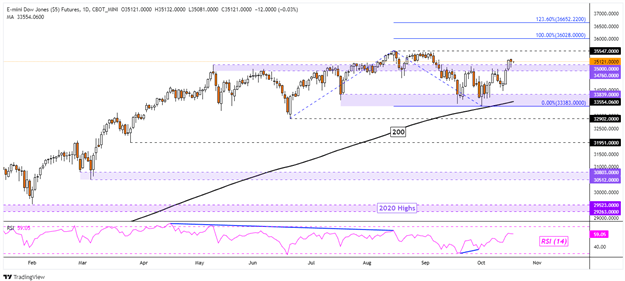

Dow Jones Technical Analysis

Dow Jones futures are holding above the 34760 – 35000 inflection zone on the daily chart below. Moreover, recent gains followed a bounced off the long-term 200-day Simple Moving Average (SMA). This could be setting the stage for the Dow to retest all-time highs. However, upside momentum has been noticeably slowing since April. Keep a close eye on RSI, signs of negative divergence could hint at another turn lower.

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Daniel Dubrovsky

Dow Jones – Daily Chart

Tuesday’s Asia Pacific Trading Session

Tuesday’s Asia-Pacific trading session is looking to be fairly quiet given a lack of key economic data. RBA meetings minutes already crossed the wires, where the central bank reiterated that it ‘will not raise rates until CPI is sustainably between 2-3%’. The ASX 200 could enjoy the anticipated recovery in economic growth as the nation moves past the Delta Covid-19 outbreak without fears about rapid monetary tightening.

Still, the slowdown in China’s economy could reverberate into Australia given their key trading relationship. But, China has been resorting to increasing Australian coal consumption despite an unofficial ban. That likely speaks to the gravity of the former’s power outage situation. Given the mostly rosy session on Wall Street, Asia-Pacific equities could be looking at a fairly upbeat day.

Trading Strategies and Risk Management

Global Macro

Recommended by Daniel Dubrovsky

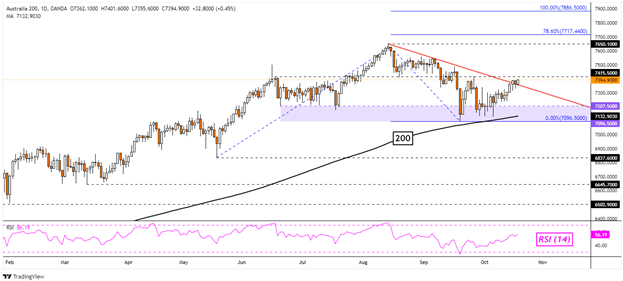

ASX 200 Technical Analysis

The ASX 200 could be on the verge of breaking above a near-term falling trendline from August following a bounce off the 200-day SMA. This would likely place the focus on the 7415 inflection point from June. Confirming a breakout above this price may open the door to a retest of the August all-time high at 7650.10. Otherwise, closing back under the trendline may place the focus on the 7096 – 7207 support zone.

ASX 200 – Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team