Rand, USD/ZAR News and Analysis

- ‘Perfect storm’ hits the rand hard as SA endures load shedding, deadly floods and the potential reversal of the risk-aligned commodity trade as global growth outlook sours

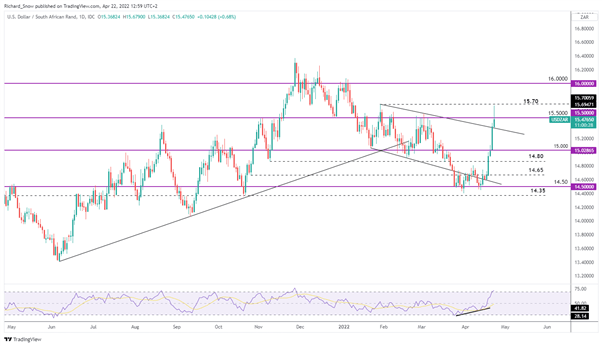

- USD/ZAR Key technical levels considered in light of the massive impulse move

National State of Disaster Declared after Deadly KZN Floods

On the 11th and 12th of April, the province of KwaZulu-Natal (KZN) received between 200 and 400 mm of rainfall over 24 hours resulting in tens of thousands being displaced, billions of rands worth of damage to infrastructure, homes and businesses; with the death toll rising above 500.

Due to the seriousness of the situation the government declared a national state of disaster to assist citizens and help repair crucial infrastructure. The impact of the floods will be felt on a national level despite the localized nature of the flooding as SA’s largest port in the coastal city of Durban has been adversely affected, resulting in shipping delays.

Power Utility Struggles to Keep the Lights on

South Africa’s sole energy supplier, Eskom announced on the 8th of April that load shedding would commence as short notice due to outages at the Kendal, Duvha, Camden and Kusile power stations. While a number of units were quickly restored, it takes time for them to ramp up to full output necessitating the use of emergency generating reserves.

IMF World Economic Outlook 2022

Earlier this week the IMF revised global growth lower, in light of the conflict in Ukraine, persistent inflation and global tightening monetary policies. Major economies saw lower revisions like the US, dropping from 4% to 3.7% and China dropping from 4.8% to 4.4%. Lower growth in the US and China equates to lower future demand for imports from exporting nations like SA, potentially resulting in further economic headwinds. Surprisingly, the IMF kept SA’s growth forecasts unchanged at 1.9% for 2022 and 1.4% for 2023.

Key Technical Levels for USD/ZAR

Over the last 4 trading days, the rand has surrendered nearly 7% of its value against the buoyant dollar. Prior to the recent spike in USD/ZAR, the rand was one of the better performing currencies when weighed up against the dollar. The greenback is fundamentally strong, benefitting from a safe-haven appeal in the early stages on the Ukraine conflict but now enjoys support from aggressive rate hike expectations throughout the rest of 2022.

Adding to the ZAR’s woes is the unravelling of the risk-aligned commodity trade which is connected to the global rate hiking cycles which reduces aggregate demand (money is more expensive to borrow) and often results in a slowdown in growth.

USD/ZAR tested the 15.70 level and has pulled back substantially from that level which coincides with the Jan 28 high. USD/ZAR tends to trade around big psychological levels (purple lines) and therefore the nearest level to consider is 15.50. A close below 15.50 highlights a retracement towards trendline support (initiated from the Jan 28 high) with secondary support all the way at 15.00.

However, the radical change in ZAR fundamentals leaves the rand susceptible to further selling. 15.70 is the next hurdle with 16.00 coming in at the secondary level of resistance.

USD/ZAR Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX