DAX 40, FTSE 100, Technical Analysis, Retail Trader Positioning - Talking Points

- Retail traders are becoming increasingly pessimistic on European equities

- Rising DAX 40 and FTSE 100 short bets indicate a contrarian market signal

- What are key technical levels to watch in the event prices continue higher?

European benchmark stock indices have been on the rise recently, pushing more retail investors to sell the rips. This can be seen by using IG Client Sentiment (IGCS). According to the data, downside bets have been on the rise in the DAX 40 and FTSE 100 indices. At times, IGCS can function as a contrarian indicator. If this trend in positioning continues, then the DAX and FTSE could be open to extending recent gains.

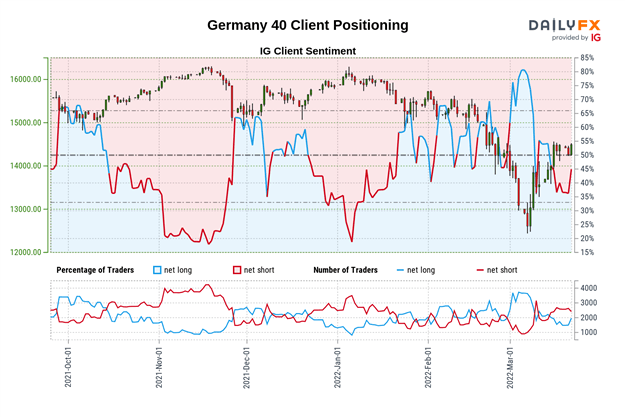

DAX 40 Sentiment Outlook - Bullish

The IGCS gauge shows that about 41% of retail traders are net-long the DAX 40. Since most traders are biased to the downside, this hints that prices may continue rising. This is as short exposure has climbed by 18.76% and 20.95% compared to yesterday and last week, respectively. With that in mind, the combination of overall and recent shifts in positioning is offering a bullish contrarian trading bias.

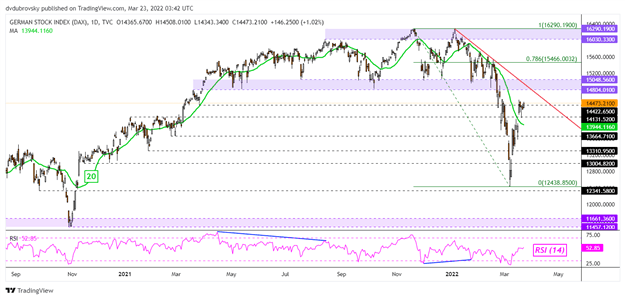

DAX 40 Daily Chart

The DAX 40 index has climbed an impressive +16% since finding a low in early March. This followed deep losses throughout January and February. Prices recently confirmed a break above the 20-day Simple Moving Average (SMA), exposing the falling trendline from December. The latter could be the next key technical test to see if there is more upside momentum to be found here. Clearing the trendline exposes the 78.6% Fibonacci retracement at 15466 before all-time highs kick in above.

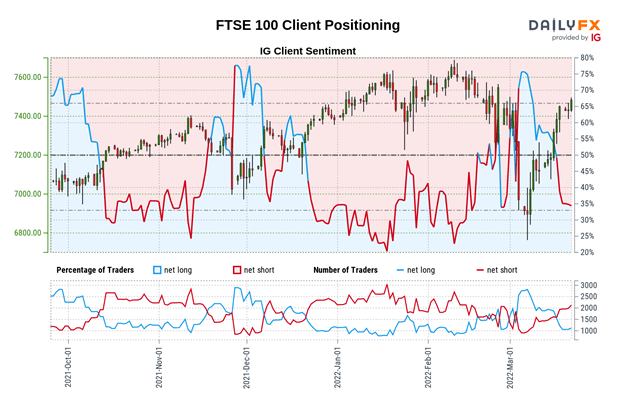

FTSE 100 Sentiment Outlook - Bullish

The IGCS gauge shows that about 33% of retail traders are net-long the FTSE 100. Since most investors are biased to the downside, this hints that prices may continue rising. This is as short bets increased by 8.59% and 43.46% compared to yesterday and last week, respectively. With that in mind, the combination of overall and recent shifts in positioning is offering a bullish contrarian trading bias.

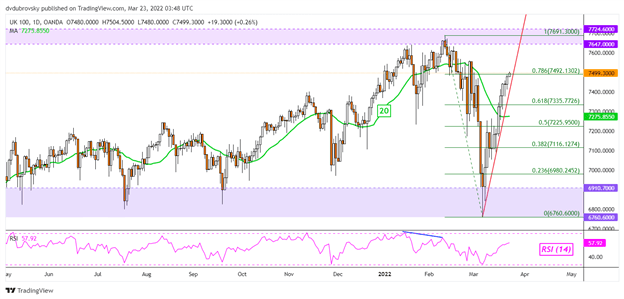

FTSE 100 Daily Chart

Like the DAX 40, the FTSE 100 is up strongly since finding a low in early March. This followed steep losses in February. Prices have confirmed a breakout above the 20-day SMA and are now testing the 78.6% Fibonacci retracement. Confirming a break above the latter may open the door to retest all-time highs, making for a key zone of resistance between 7646 and 7724. On the downside, keep a close eye on a near-term rising trendline from the beginning of March. Falling under it risks opening the door to losses.

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Daniel Dubrovsky

*IG Client Sentiment Charts and Positioning Data Used from March 22nd Report

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter