Major US indices turned in weaker overnight, with the Nasdaq reversing its previous day’s gains, as big tech stocks faltered despite Treasury yields little changed. Apple’s new product launch failed to impress, prompting a 1.7% overnight drop in its share price. Its new iPhone selling prices seeing not much of an increase seems to provide testament to the still-soft demand for the global smartphone market, despite some improvement in global shipments in 2Q 2023.

Ahead, all eyes will be on the US Consumer Price Index (CPI) data tonight, with the story likely to revolve around a resurgence in headline pricing pressures, but also further cooling in US core inflation. The headline inflation is expected to head higher to 3.6% from a year ago, up from the previous 3.2%. On the other hand, the core aspect is expected to moderate to 4.3% from previous 4.7%, with the key focus on whether a softer core inflation read will be sufficient for the Fed to keep rates on hold into next year.

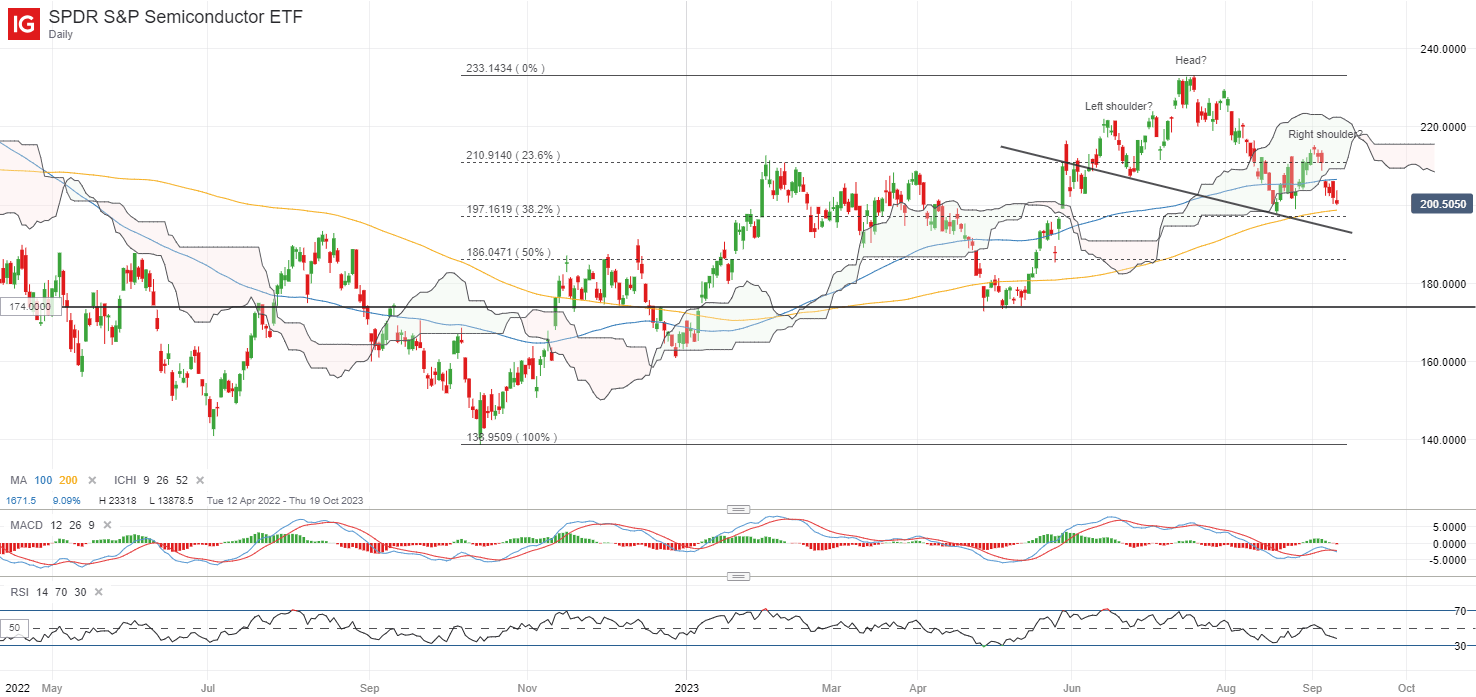

The US dollar is little changed into today’s session, while US equity futures tread on their usual wait-and-see. Perhaps one to watch ahead may be the SPDR S&P Semiconductor ETF, which seems to display a potential head-and-shoulder pattern in formation. The neckline support at the 193.00 level may be crucial for buyers to defend, failing to do so may potentially pave the way to retest its May 2023 bottom at the 174.00 level next. Its weekly relative strength index (RSI) is currently back at its neutral 50 level, which may suggest a point of reckoning ahead.

Source: IG charts

Asia Open

Asian stocks look set for a mixed open, with Nikkei +0.27%, ASX -0.62% and KOSPI +0.44% at the time of writing. Higher oil prices may keep an overall cautious mood in place, given that most economies in the region are net oil importers, while little moves around the US dollar may also call for some wait-and-see ahead of the US CPI release. Chinese equities largely remain in its subdued state, as investors also look towards a slew of economic data out of China this Friday, where the trend of downside surprises over the past months may keep sentiments in check for now.

The economic calendar this morning saw South Korea’s unemployment rate head to a new record low in August (2.4% versus previous 2.8%), which may call for the Bank of Korea (BOK) to retain a hawkish stance and some policy flexibility for additional tightening if needed. That said, the USD/KRW did not see much of a move in today’s session, reflecting some reservations over prevailing growth risks justifying a prolonged rate hold for now. On the other hand, Japan’s wholesale inflation for August saw its eighth straight month of moderation, which provide room for the Bank of Japan (BoJ) for a more gradual policy normalisation process.

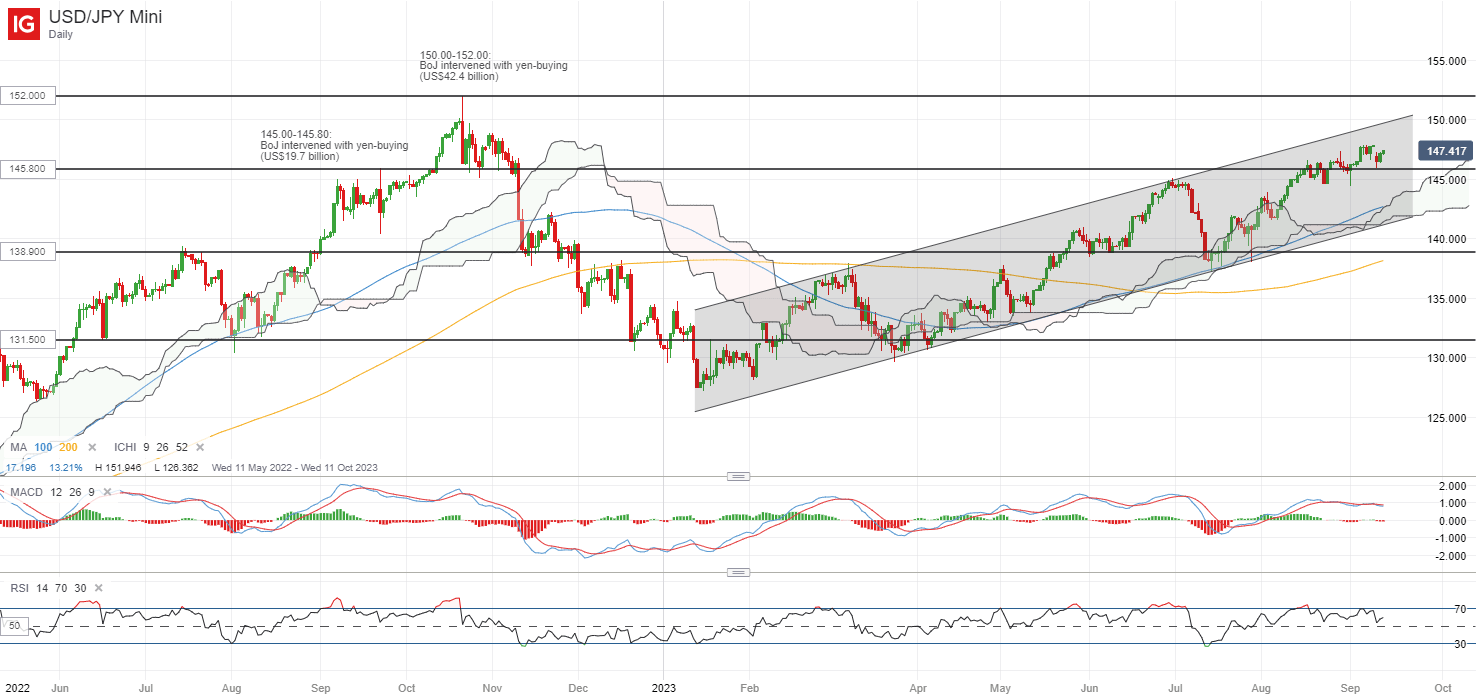

Upon a retest of the 145.80 level of support, the USD/JPY is back on its climb, further validating the level as a key support to defend for buyers. An ascending channel pattern remains broadly in place since the start of the year, which keep the overall trend bias to the upside. Further move above its early-September high could place the 149.90 level on watch next – the next level of yen-buying intervention by the BoJ back in October 2022.

Source: IG charts

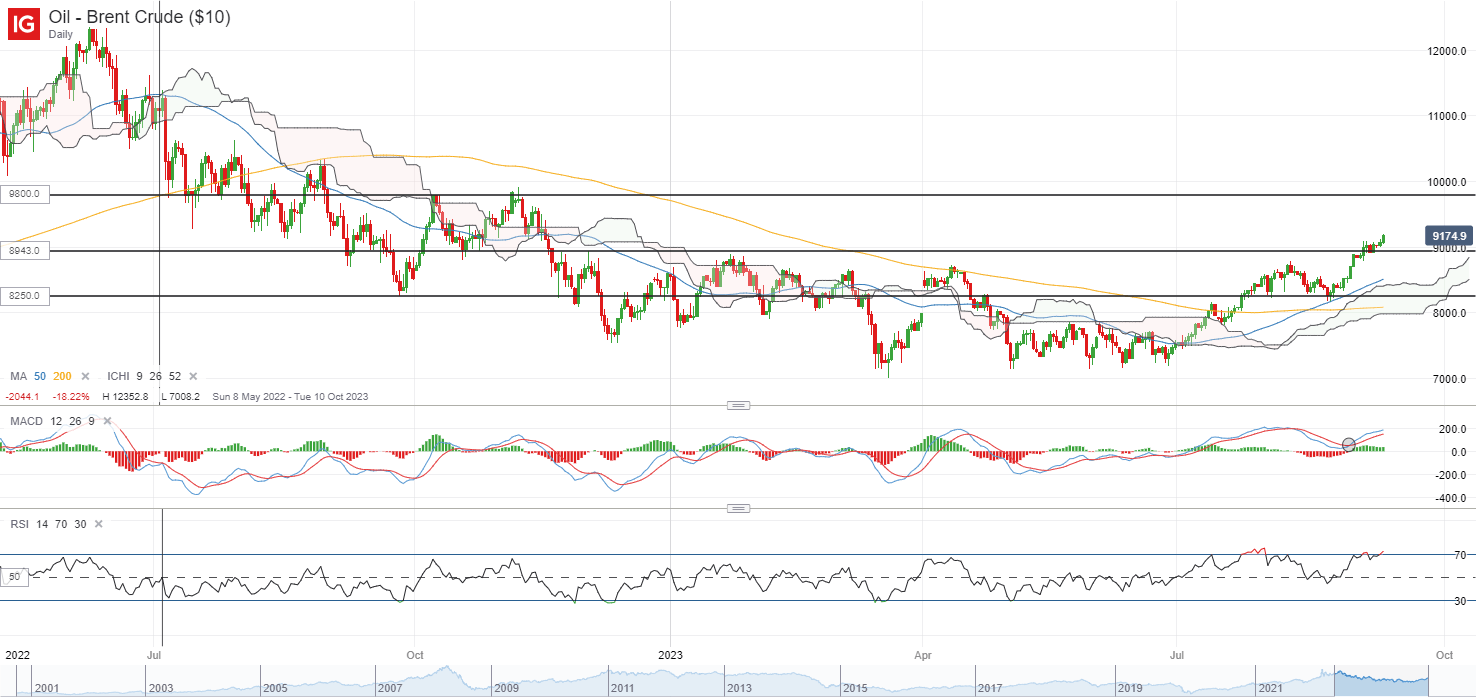

On the watchlist: Brent crude prices continue its ascent to new 10-month high

Following a slight consolidation over the past week, oil prices have resumed its ascent to deliver a new 10-month high overnight, successfully defending its key US$90.00 level for Brent crude. The latest surprise build in US crude oil API data may serve as a slight dampener, but given that the trend from the official inventory data (EIA) over the past month is still on heavy drawdowns, while the US Strategic Petroleum Reserve (SPR) inventories remain around its 40-year low, it may have to take more than a single data to overturn the tight-supplies narrative.

A firm stick by OPEC to its optimistic forecast for global oil demand into next year also provides some reassurances for the prevailing upward trend in oil prices since July this year. For now, as technical conditions head into near-term overbought territory, the US$90.00 will be on watch as immediate support to hold, while prices eye for a retest of the US$98.00 level ahead.

Source: IG charts

Tuesday: DJIA -0.05%; S&P 500 -0.57%; Nasdaq -1.04%, DAX -0.54%, FTSE +0.41%