Bank of England Leaves Rates Unchanged, Sterling and Gilt Yields Drift Lower

GBP/USD Analysis and Charts

- BoE leaves monetary policy untouched.

- The next Quarterly Economic Forecast (August) is now key.

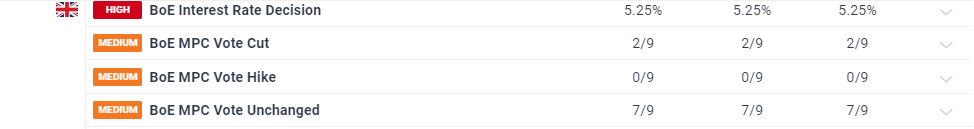

A fairly uneventful Bank of England Monetary Policy decision with interest rates left unchanged at 5.25%. Two members called for rates to be cut by 25 basis points, while the other seven voted for rates to be left untouched.

For all market-moving economic data and events, see the DailyFX Economic Calendar

In the accompanying minutes the UK central bank said, 'As part of the August forecast round, members of the Committee will consider all of the information available and how this affects the assessment that the risks from inflation persistence are receding. On that basis, the Committee will keep under review for how long Bank Rate should be maintained at its current level,’ suggesting that an August rate cut may be on the cards if inflation risks continue to recede.

Market pricing now shows a 44% chance of an August cut.

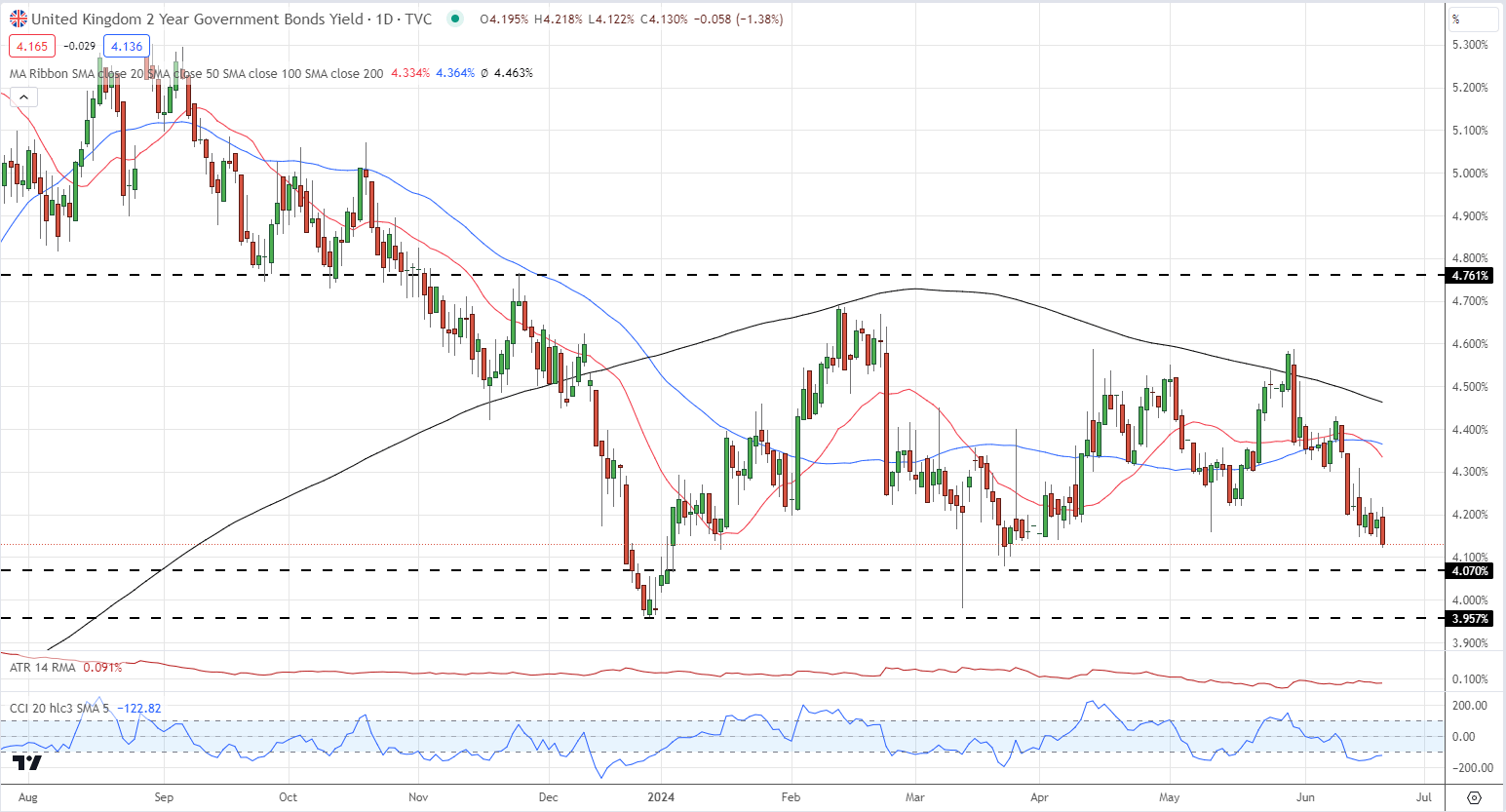

UK 2-year Gilt yields fell around 6 basis points after the announcement to 4.122%, the lowest level in nearly three months.

UK 2-Year Gilt Yields

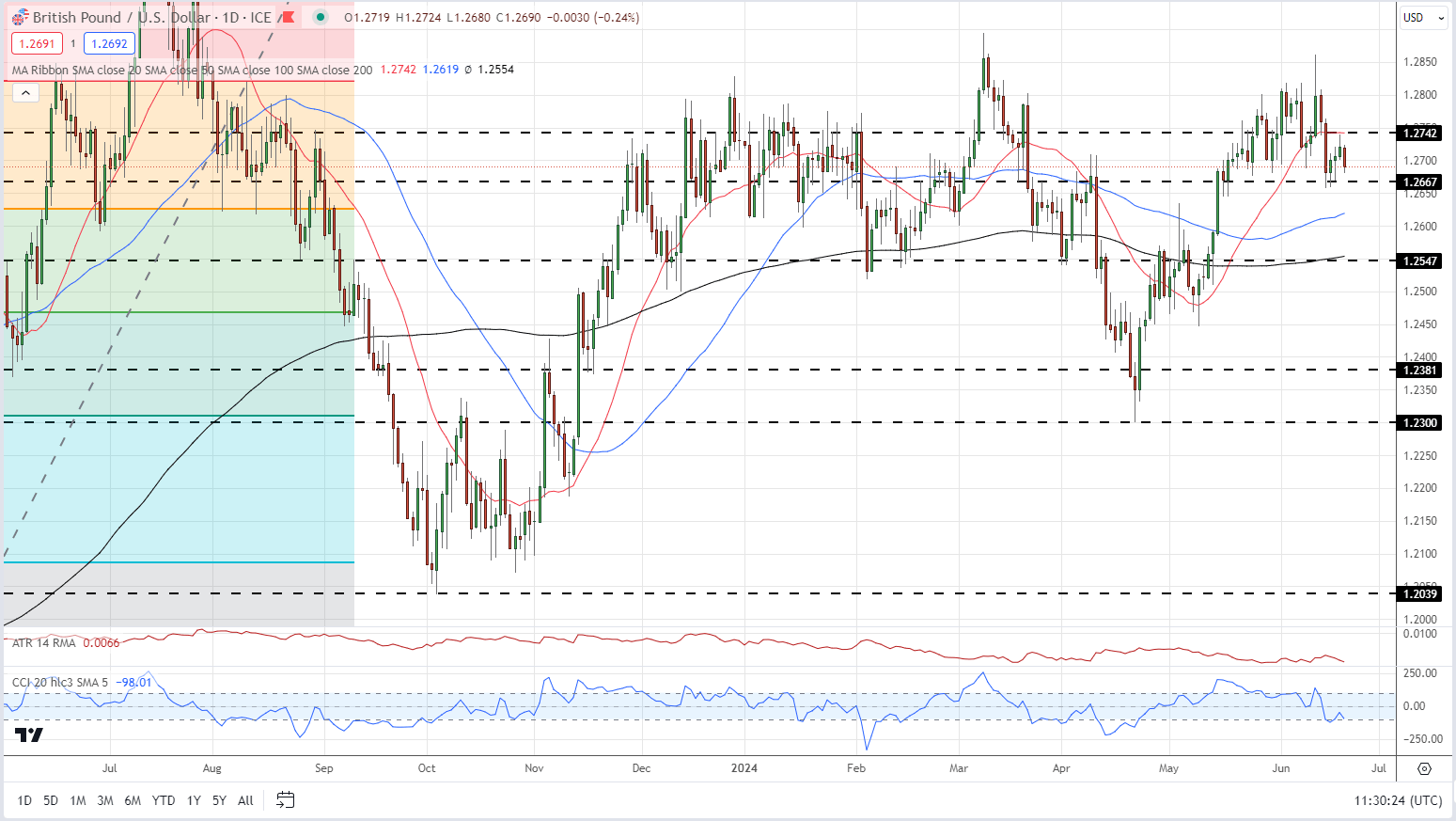

Cable slipped around 20 pips after the announcement and currently trades around 1.2685. The next level of support is around 1.2667 ahead of the 38.2% Fibonacci retracement level at 1.2626.

GBP/USD Daily Price Chart

Charts using TradingView

Retail trader data shows 46.72% of traders are net-long with the ratio of traders short to long at 1.14 to 1.The number of traders net-long is 2.81% lower than yesterday and 34.45% higher than last week, while the number of traders net-short is 3.91% higher than yesterday and 12.00% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

Download the full report to see how changes in IG Client Sentiment can help your trading decisions:

| Change in | Longs | Shorts | OI |

| Daily | 26% | -23% | -2% |

| Weekly | 21% | -11% | 4% |

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.