British Pound Fundamental Forecast: Bullish

- British Pound pushes higher against the US Dollar last week

- Softening US inflation increased less hawkish Fed policy bets

- Focus shifts to UK CPI and employment data in the week ahead

The British Pound gained 1.11 percent against the US Dollar last week, causing GBP/USD to close at its highest since the middle of December. This is despite some disappointing local economic data. UK Industrial production clocked in at -5.1% y/y against the -2.8% consensus in November. Manufacturing production also surprised lower for the same period.

Markets were likely focused on the United States this past week. US inflation crossed the wires at 6.5% y/y, which was in line with expectations. Heading into the data, markets were probably increasingly anticipating a softer-than-expected outcome. But, statistically speaking, this scenario looked unlikely before the data crossed the wires.

Still, markets viewed the in-line outcome as maybe boosting the probability of a sooner-than-anticipated pivot from the Federal Reserve. In fact, markets continue to increasingly diverge from what the central bank is looking at for interest rates. Fed funds futures are seeing rates climb in the following couple of months before cuts are introduced heading into the end of the year. That would leave rates below the median FOMC dot plot projection for this year.

This could be setting up a situation of disappointment, opening the door for the Sterling to weaken against the US Dollar down the road. For the time being, the focus shifts to the United Kingdom in the week ahead. We will get UK CPI on Wednesday. Headline inflation is seen softening to 10.5% y/y in December from 10.7% prior. The core gauge is estimated at 6.2% y/y, down from 6.3% prior.

UK employment data will also cross the wires earlier on Tuesday. Weekly earnings excluding bonus are seen improving to 6.3% 3M/YoY from 6.1% prior. The Citi Economic Surprise Index tracking the UK remains positive. This means that the bias here could be to upside data surprises. That may keep a hawkish Bank of England in focus relative to the Fed. As such, the British Pound may continue higher in the near term.

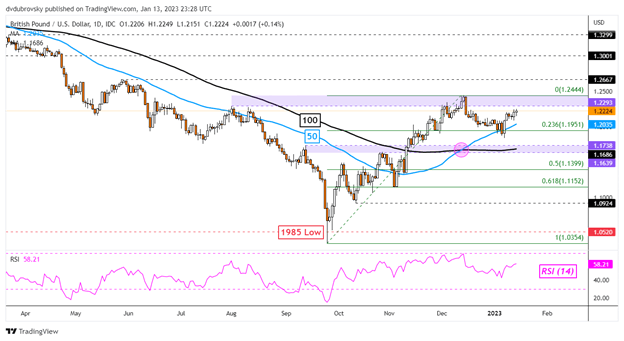

British Pound Daily Chart

Chart Created in TradingView

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX