Canadian CPI, CAD Analysis

- Canadian CPI beats estimates, putting a July cut in jeopardy

- USD/CAD lifts momentarily but markets are focused on US GDP, PCE data

- CAD/CHF may see further joy after the SNB cut rates for the second successive time

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Canadian Inflation Catches Markets Off Guard with Upward Surprise in May

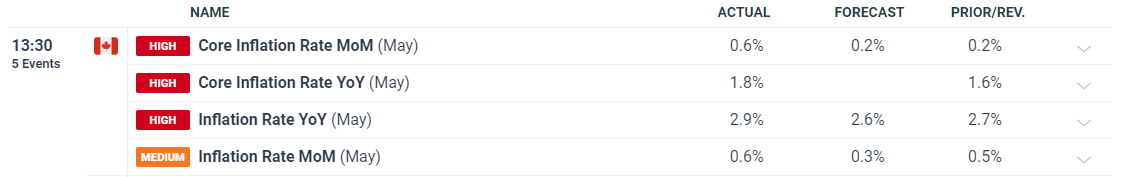

Canadian measures of inflation wrongfooted markets today, coming in hotter-than-expected. Monthly and yearly headline inflation (CPI) both beat the maximum estimates of 0.4% and 2.7% respectively, coming in at 0.6% and 2.9%. Core inflation also rose above the prior measure of 1.6 to emerge at 1.8%.

Customize and filter live economic data via our DailyFX economic calendar

Learn how to prepare for high impact economic data or events with this easy to implement approach:

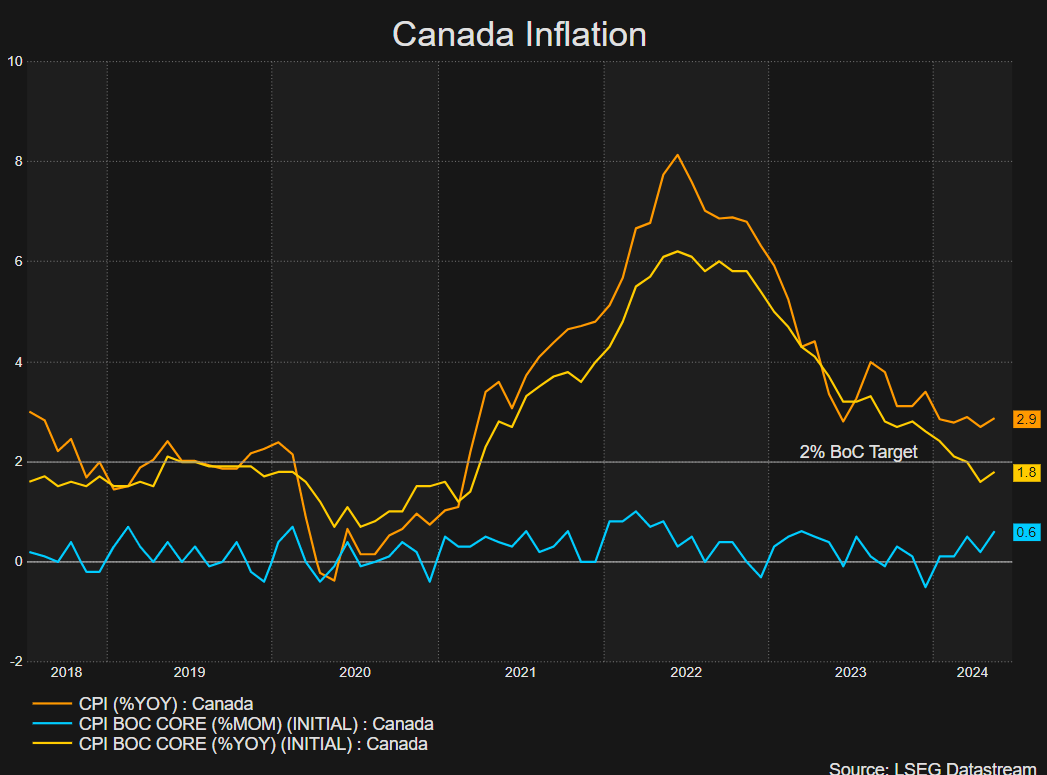

Canadian inflation has been one of the success stories amongst developed markets, declining towards 2%. The Bank of Canada even decided to cut interest rates by 25 basis points the last time they met but the recent lift in price pressures has put a July cut in jeopardy.

Source: Refinitiv, prepared by Richard Snow

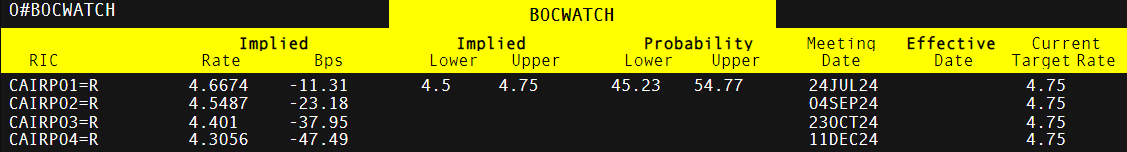

Market expectations for another Bank of Canada rate cut have decreased following the inflation data. Swap markets now indicate that investors believe there's a 46% probability of a rate reduction at the July policy meeting, down from 65% previously.

The Bank of Canada recently took the lead among G7 nations in monetary easing, reducing its key interest rate by 0.25 percentage points to 4.75% earlier this month.

BoC Implied Rate Cut Percentages and Basis Points

Source: Refinitiv, prepared by Richard Snow

Market Reaction: USD/CAD, CAD/CHF

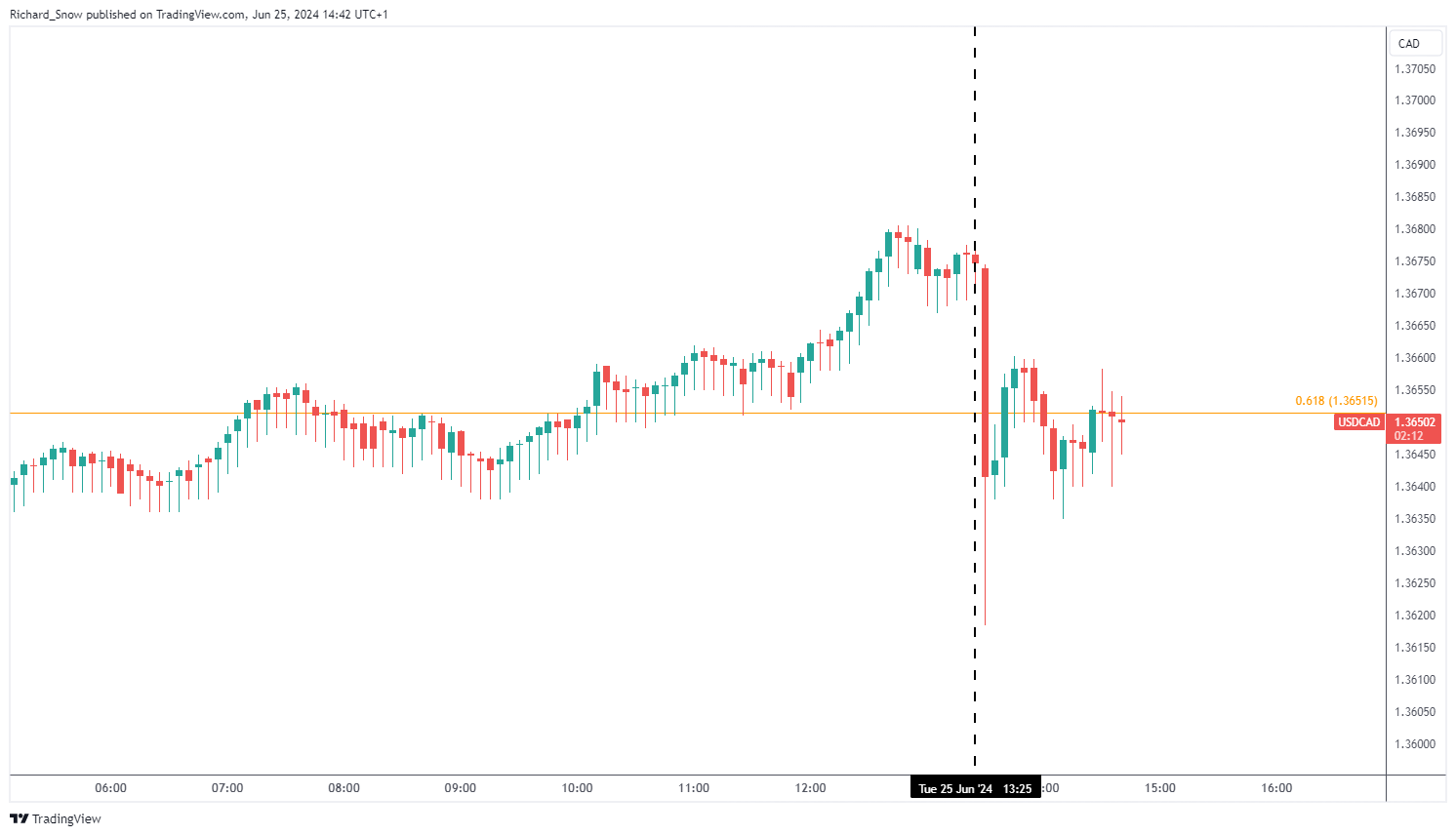

USD/CAD showed an initial reaction lower as the Canadian dollar firmed slightly against the greenback. The initial move, however, appears contained as traders await the final US GDP data for the first quarter and more importantly US PCE data on Friday – with lower prints carrying the potential to overpower this recent lift in USD/CAD.

USD/CAD 5-Minute Chart

Source: TradingView, prepared by Richard Snow

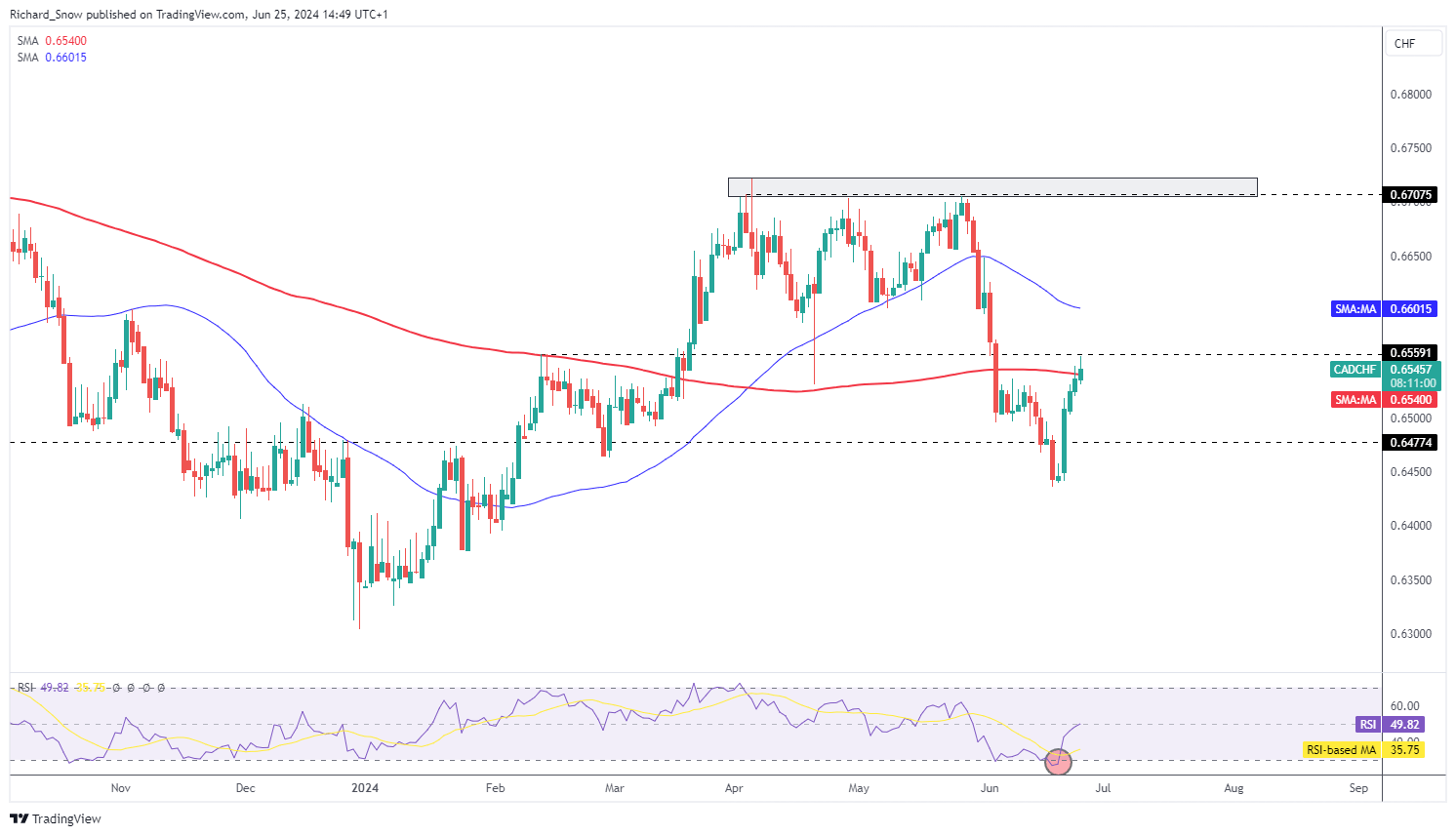

CAD/CHF continues to rise, now breaking above the 200 SMA. The pair turned around after the bullish engulfing pattern provided a pivot point as the pair emerged from oversold conditions.

CAD/CHF Daily Chart

Source: TradingView, prepared by Richard Snow

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, "Traits of Successful Traders," and gain valuable insights to steer clear of common pitfalls

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX