Dax, Dow Jones, FTSE Outlook:

- Dow Jones outlook weighed down by Goldman Sachs earnings – DJI uncertain around 34,000.

- FTSE 100 trades flat as narrow range forms below the all-time high.

- Dax 40 futures remain optimistic despite technical headwinds

Dax 40 Outlook:

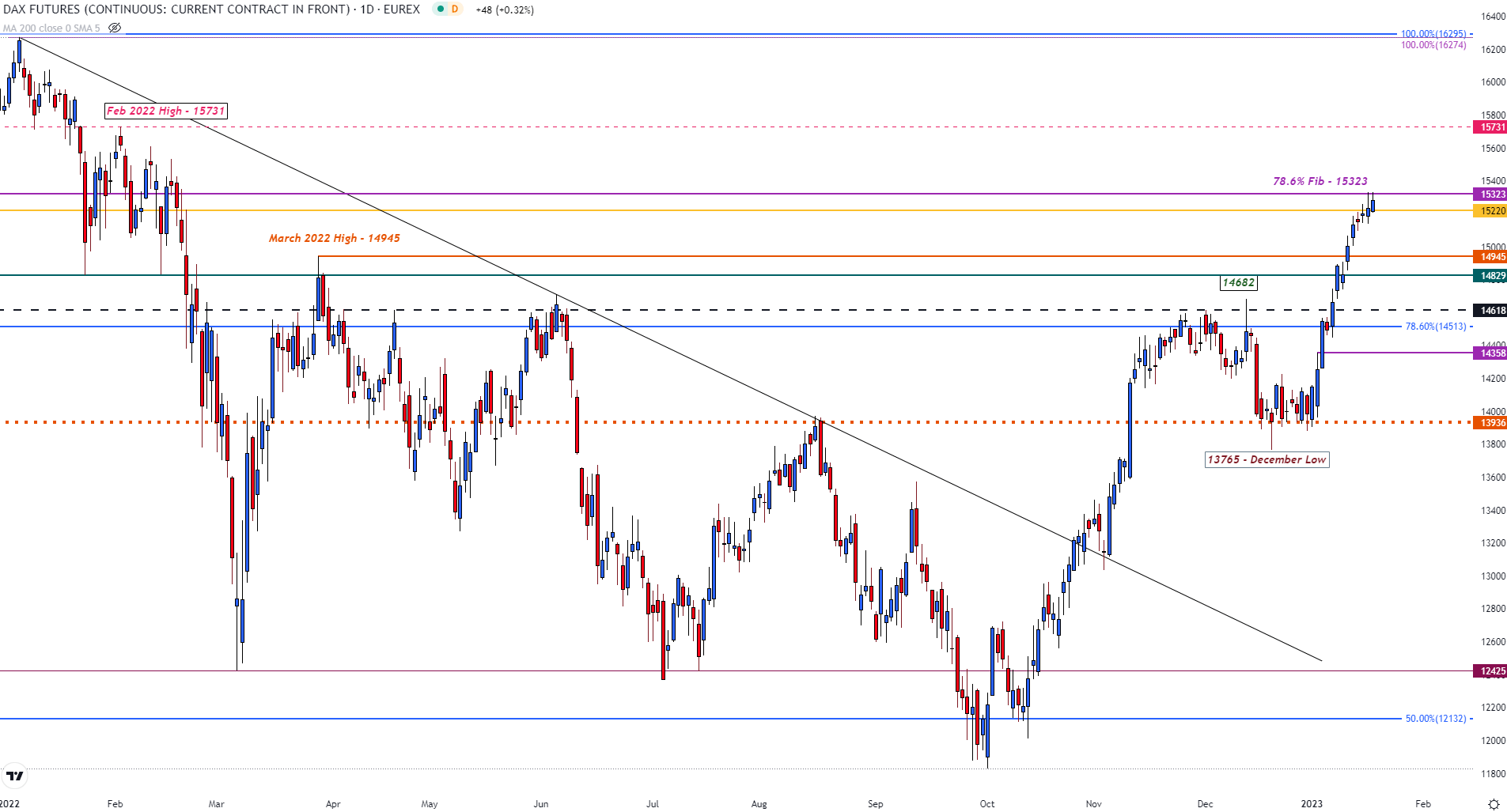

After rising above 14,000 for the first time in January 2021, the German index continued higher before peaking at 16,295 in November that same year. Although fiscal stimulus and quantitative easing assisted in driving the initial move, a shift in the global inflation narrative forced central banks to increase interest rates.

Visit the DailyFX Educational Center to discover the impact of politics on global markets

As the ECB (European Central Bank) embarked on a journey to tame price pressures through restrictive monetary policy, Dax futures fell before rebounding off the October 2022 low of 11,829.

In the wake of the Covid-19 pandemic, Dax futures experienced a historic move along with many of its major counterparts.

Since then, a steady rally and a slight pullback has been met with a stern reaction from bulls. With Dax prices currently trading higher, a break of 15,000 has provided a sense of comfort to bulls.

Dax Daily Chart

Chart prepared by Tammy Da Costa using TradingView

While the 78.6% Fibonacci of the 2022 move remains at 15,323, the 15,400 psychological zone of resistance remains intact. With the current weekly range holding between 15,140 and 15,332, a move higher and bullish continuation above 15,400 could drive Dax back above 15,500.

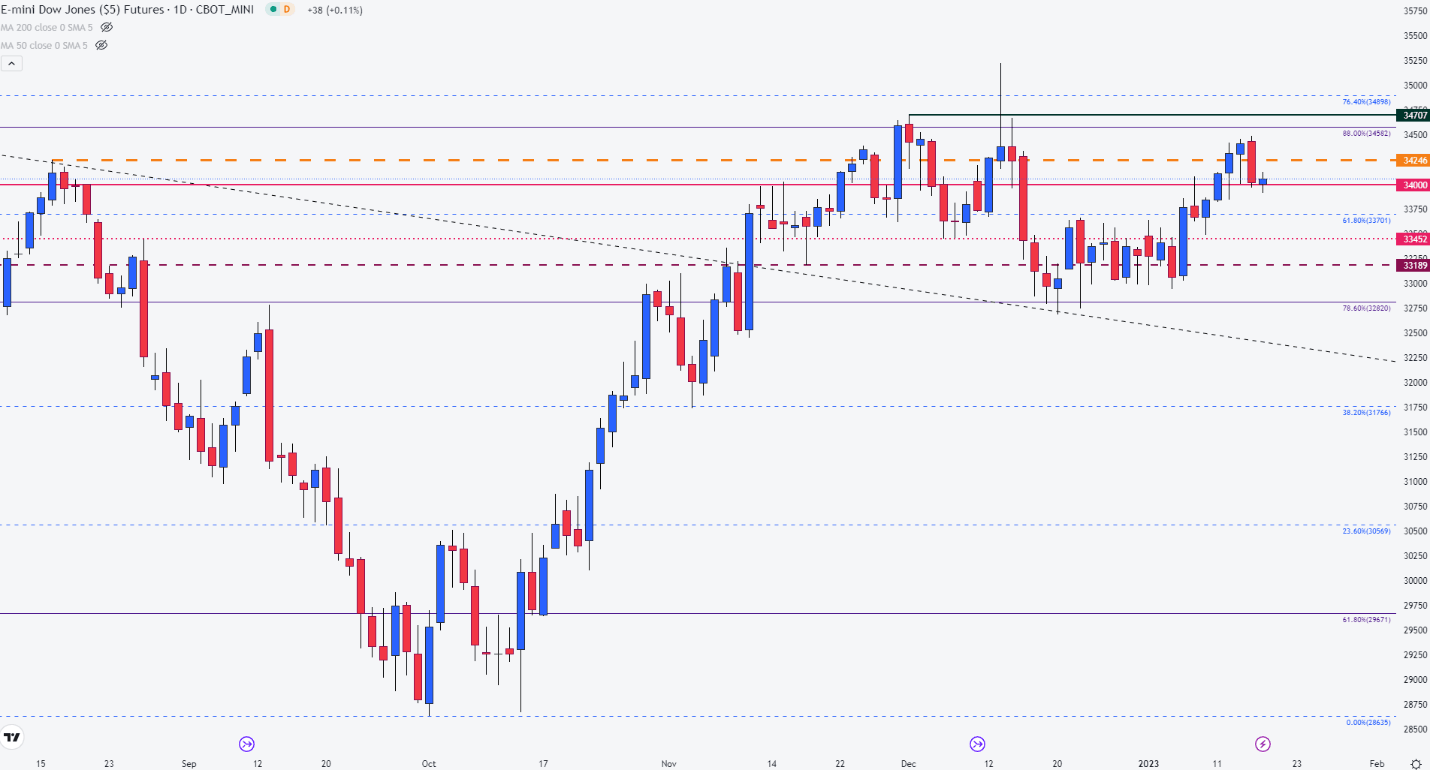

Dow Jones (DJI) Analysis:

After rising above the 50-day MA (moving average) at 33,675, Dow futures retested 34,000 before pausing at 34,489. With dismal Goldman Sachs Q4 earnings weighing on US equity futures, Dow retraced back to that same zone of support at the prior resistance level of 34,000.

As the index searches for a fresh directional bias, price action could move in either direction. For bullish momentum to gain traction, prices would need rise above 34k and clear 35,000.

Dow Jones (DJI) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

On the contrary, a drop below 33,750 and below the 50-day MA could fuel bearish momentum. If sellers drive prices below 33,450, the next level of support could come into play at 33,189.

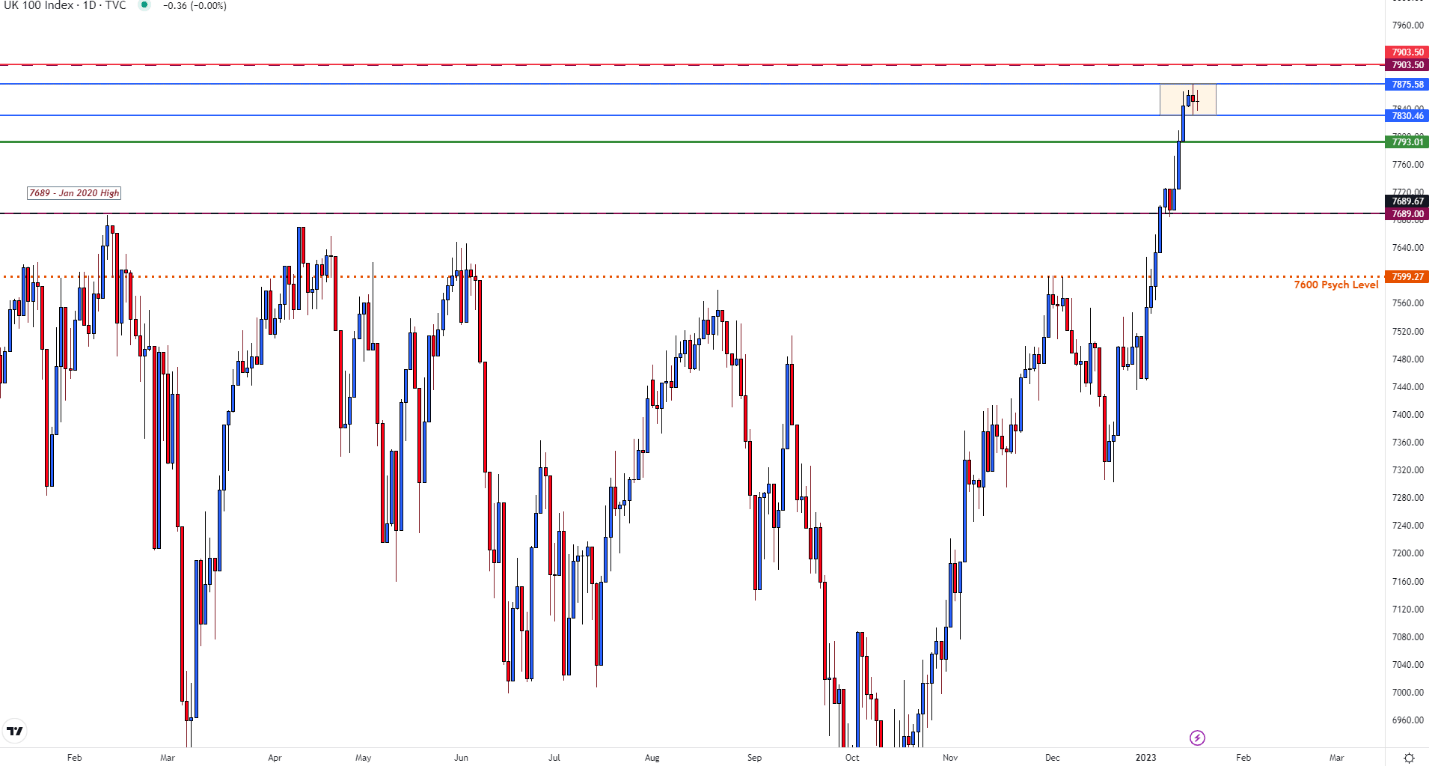

FTSE 100 Forecast

Although the FTSE 100 has been the outperformer since the start of 2023, bullish momentum has stalled. With the daily chart highlighting the tight of support and resistance forming between 7,830 and 7,875; buyers will need to dig deep to find a fresh catalyst that could lead them to a retest of the all-time high at 7,903.

FTSE Daily Chart

Chart prepared by Tammy Da Costa using TradingView

| Change in | Longs | Shorts | OI |

| Daily | -7% | 14% | 4% |

| Weekly | -6% | 12% | 4% |

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707