USD/JPY FORECAST:

- USD/JPY slumps in late trading, erasing early session gains despite soaring U.S. Treasury yields

- Media reports that the Bank of Japan could tweak its yield curve control program boosts the yen across the board

- BoJ will announce its monetary policy decision for its July meeting on Friday (Japan time)

Most Read: US Second-Quarter GDP Growth Shatters Estimates, Boosting Yields and the Dollar

USD/JPY was on track for a solid rise Thursday morning after U.S. second-quarter GDP growth beat consensus estimates by a wide margin, but gave up its advance and swung sharply lower in afternoon trading on news that the Bank of Japan may surprise markets with a change to its yield curve control program at its July monetary policy meeting scheduled to end on Friday (Japan time).

Financial magazine Nikkei Asia reported that the BoJ would discuss modifying its YCC scheme to permit long-term interest rates on government debt to climb above its current band of 0.0% to 0.5%, using the expected upward revision of its inflation forecast as an excuse to start moving away from its ultra-accommodative stance.

According to the media outlet, the BoJ is considering allowing rates to float beyond the cap in a controlled and gradual fashion, without permitting disruptive and sudden spikes that could roil financial markets. The bank has neither confirmed nor refuted the information.

If the country's monetary authority follows through with this plan, Japanese yields are likely to creep up to the new YCC ceiling quickly, eventually compressing rate differentials with developed markets and buoying the yen. Initially, however, global yields could rise in tandem with those in Japan, as Japanese investors sell their foreign bond holdings in favor of domestic debt.

While more details are needed to assess the outlook, if global yields were to rally aggressively in a short period of time, volatility could pick up overnight, throwing markets into turmoil. This scenario could disrupt the 2023 equity rally, creating a constructive backdrop for safe-haven assets.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -8% | -6% |

| Weekly | 23% | -8% | -3% |

USD/JPY TECHNICAL OUTLOOK

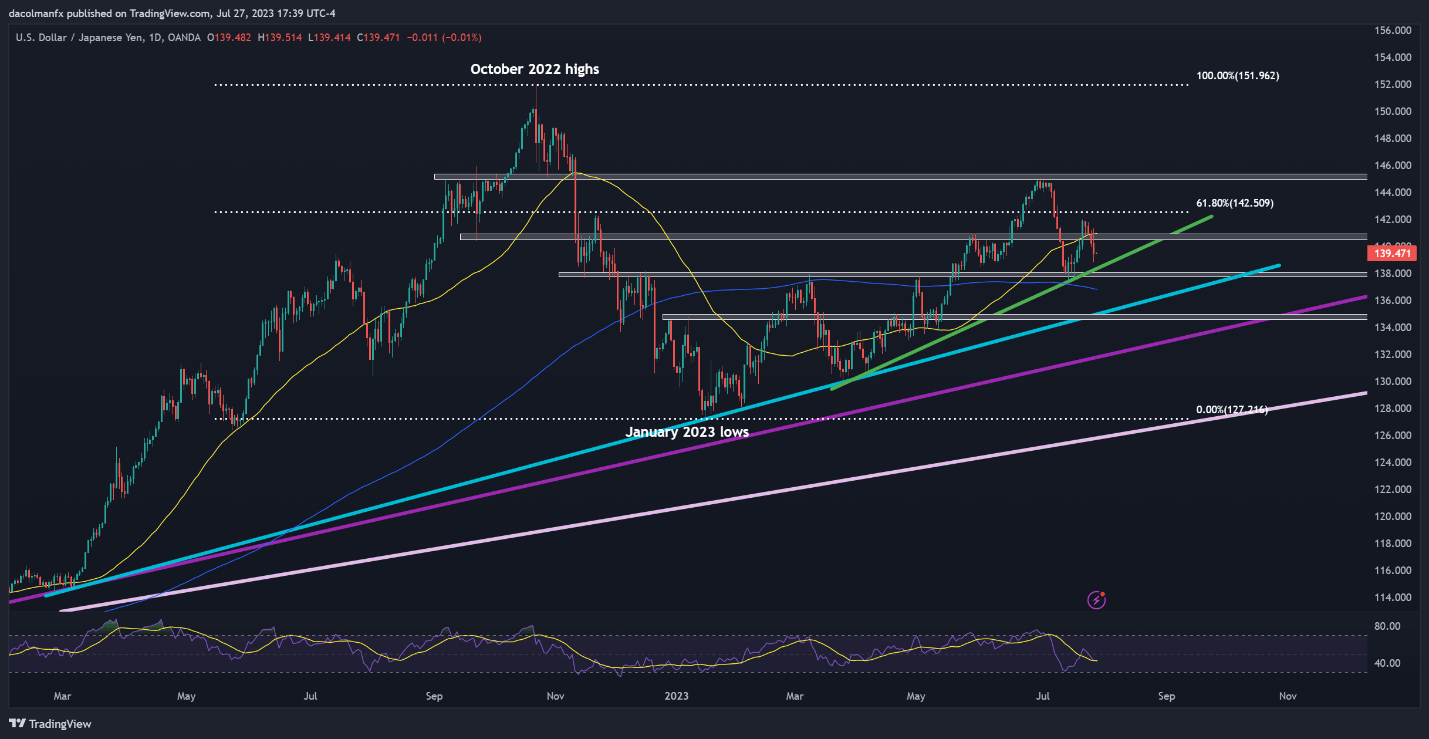

After the recent pullback, USD/JPY is hovering slightly above confluence support, stretching from 138.50 to 137.75. If bears manage to push prices below this floor, we could see a move toward the 200-day simple moving average, followed by a possible retest of the psychological 135.00 level.

On the flip side, if USD/JPY resumes its ascent, initial resistance appears at 141.00, followed by 142.50, the 61.8% Fibonacci retracement of the October 2022/January 2023 slump. If these technical barriers are taken out, bulls could become emboldened to launch an attack on the 2023 peak.

USD/JPY TECHNICAL CHART