Gold and Silver Outlooks and Charts

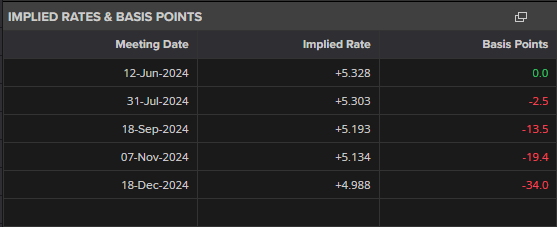

The recent re-pricing of US interest rate cuts continues to weigh on gold and silver, dampening demand for the previously high-flying commodities. The latest market forecasts show the first 25 basis point US rate cut is now fully priced for the December meeting, although the November meeting remains in play. Strong US economic data of late gives the Fed additional wiggle room to keep rates higher for longer as the US central bank continues its battle with stubbornly sticky inflation.

Source: LSEG Datastream.

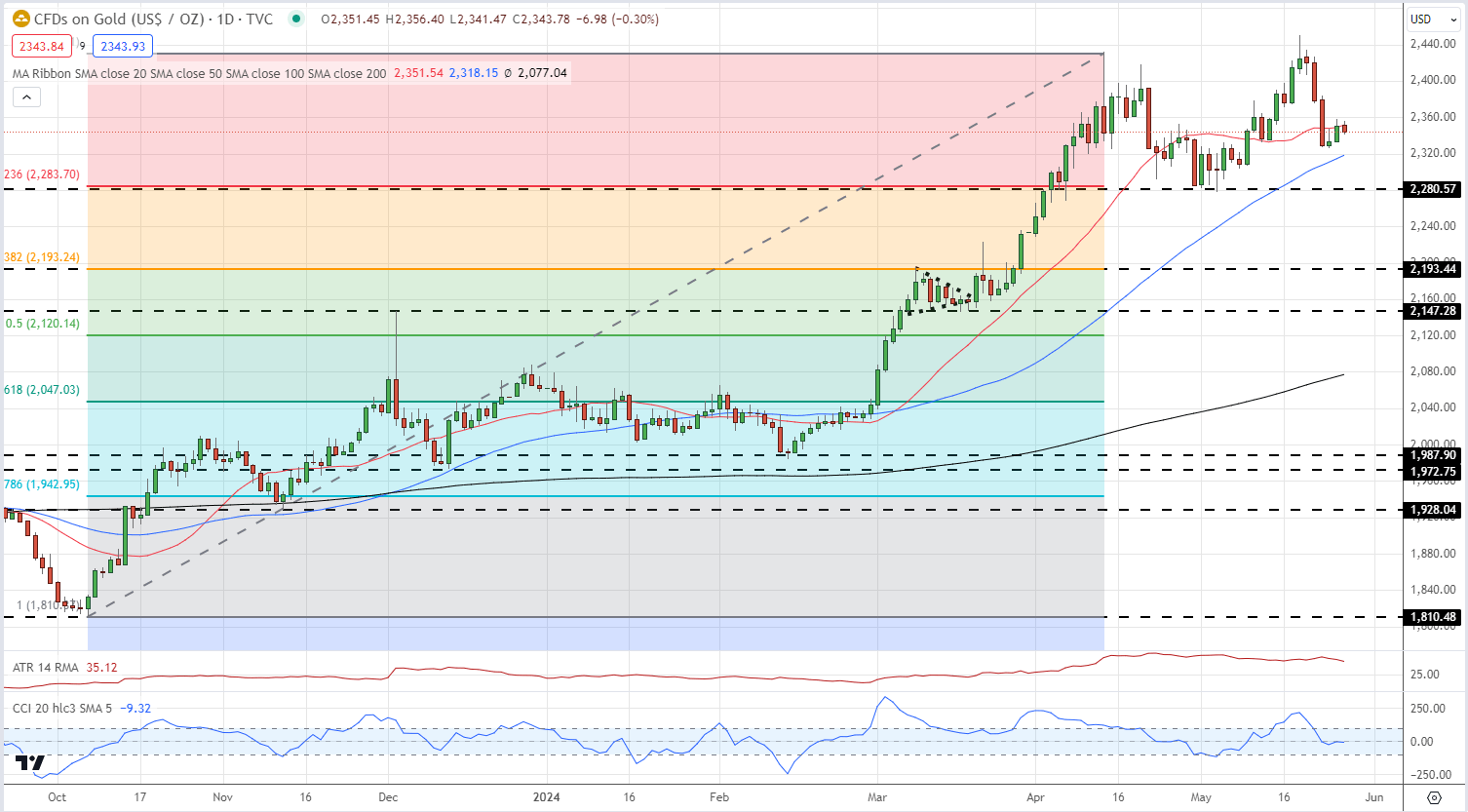

After printing a fresh multi-decade high on May 20th, gold has fallen by over $100/oz. on further Fed speculation of higher rates and strong economic data. Short-term US Treasury yields remain elevated, keeping downward pressure on gold and silver, and unless Friday’s PCE data surprises to the downside, both gold and silver may struggle to move higher. In the case of any further sell-off, gold should find initial support at around $2,280/oz.

Gold Daily Price Chart

Retail trader data show 63.97% of traders are net-long with the ratio of traders long to short at 1.78 to 1.The number of traders net-long is 3.95% higher than yesterday and 36.52% higher than last week, while the number of traders net-short is 6.68% higher than yesterday and 20.68% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

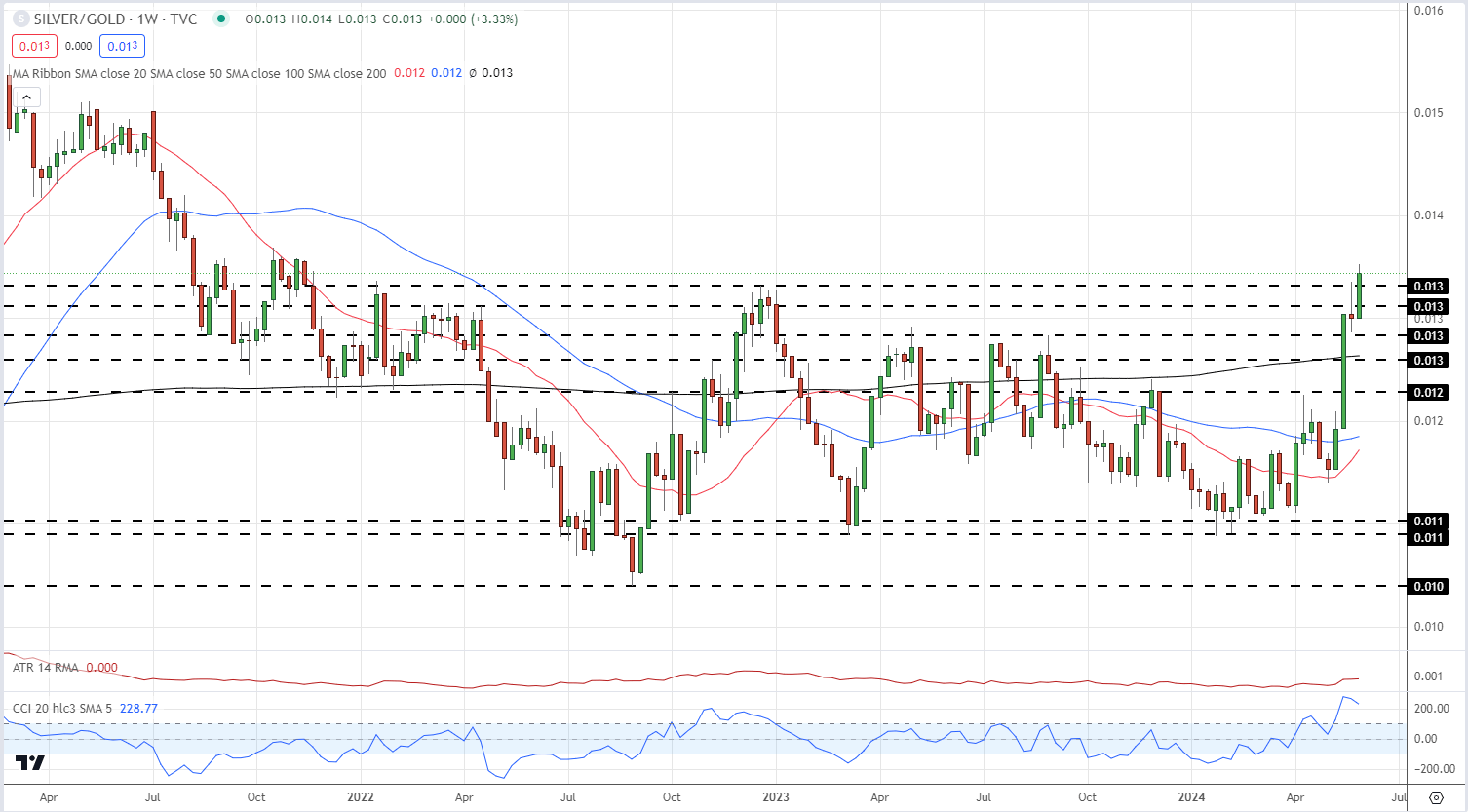

Silver has outperformed gold over the last month with the silver/gold spread now back at highs last seen in mid-November 2021. A break, and open, above the mid-October 2021 high would give this spread room to move higher.

| Change in | Longs | Shorts | OI |

| Daily | -6% | -4% | -5% |

| Weekly | -9% | 10% | -1% |

Silver/Gold Weekly Price Chart

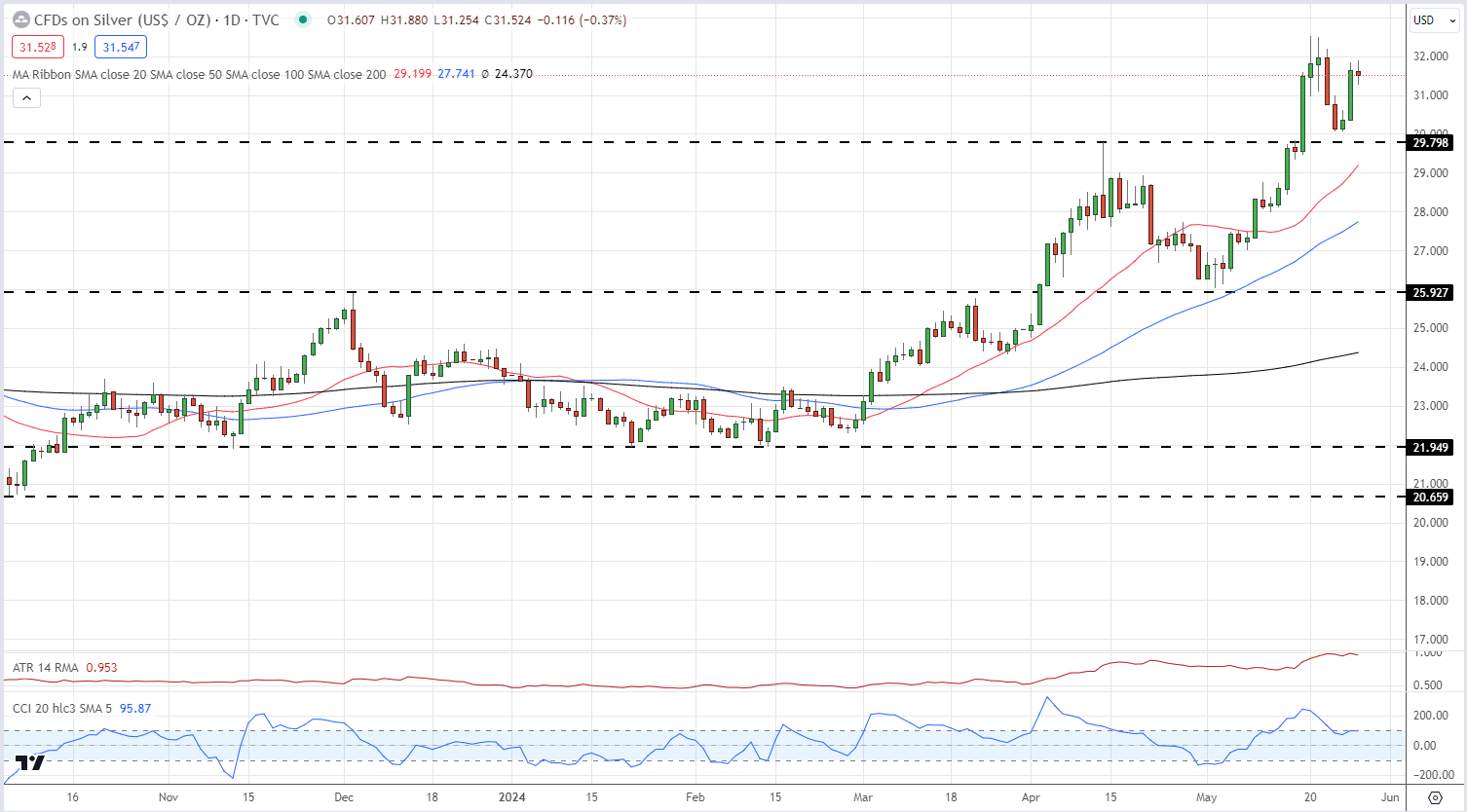

Silver recently traded at its highest level in over a decade, breaking the $30/0z. barrier with ease. This level, supported by a prior high at $29.80/oz. now turns into short-term support.

Silver Daily Price Chart

All Charts via TradingView

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.