Gold (XAU/USD) News and Analysis

- Global central banks indicated a continued willingness to increase gold holdings

- Gold remains within a downtrend since declining from the all-time-high, the shorter-term rise looks to be contained

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

World Gold Council Survey Points to Increasing Gold Holdings

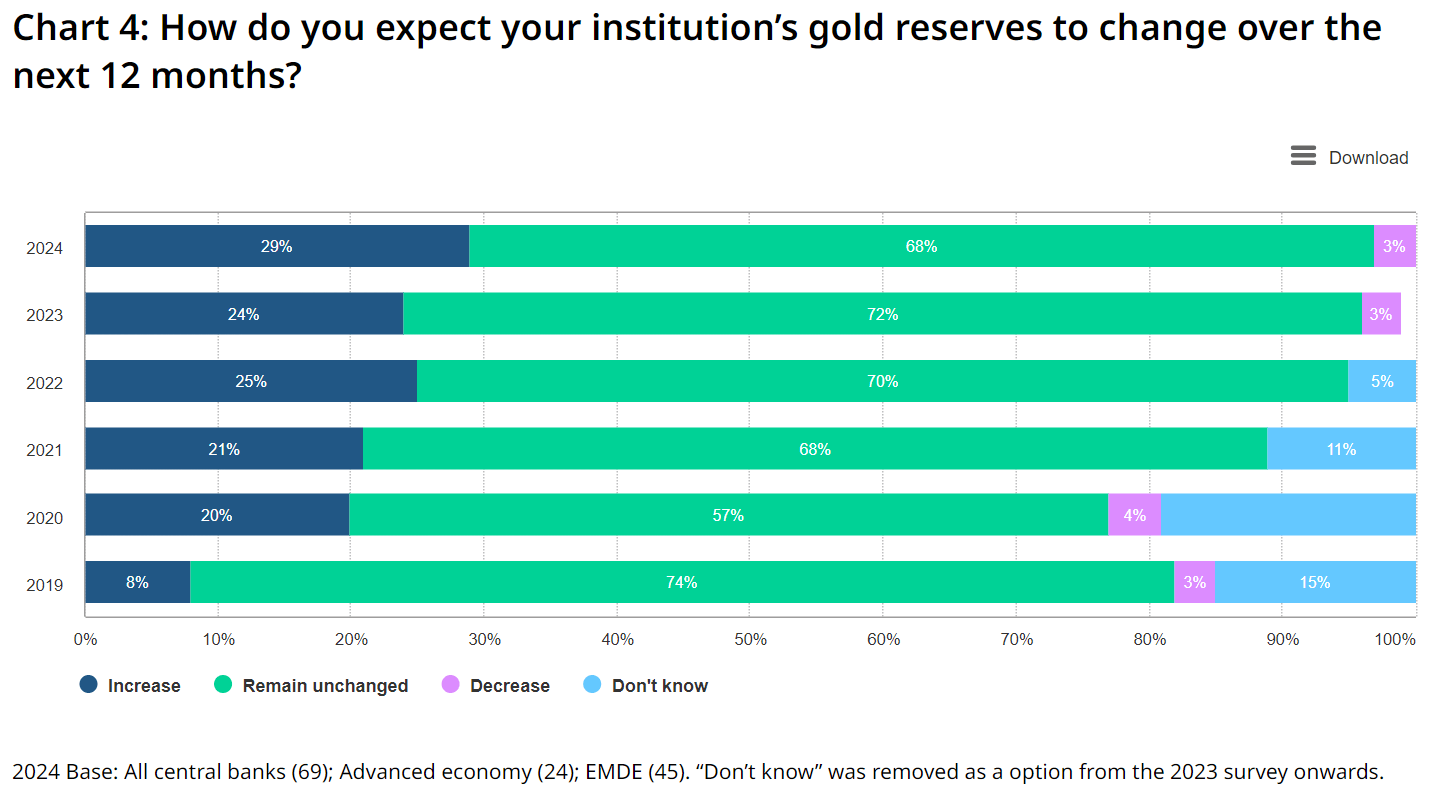

The World Gold Council's annual survey, which included responses from 69 central banks was conducted between February and April and showed that 29% of central banks expect their own gold reserves to rise, the highest percentage since the survey began in 2018 despite relatively high gold prices.

Source: WGC 2024

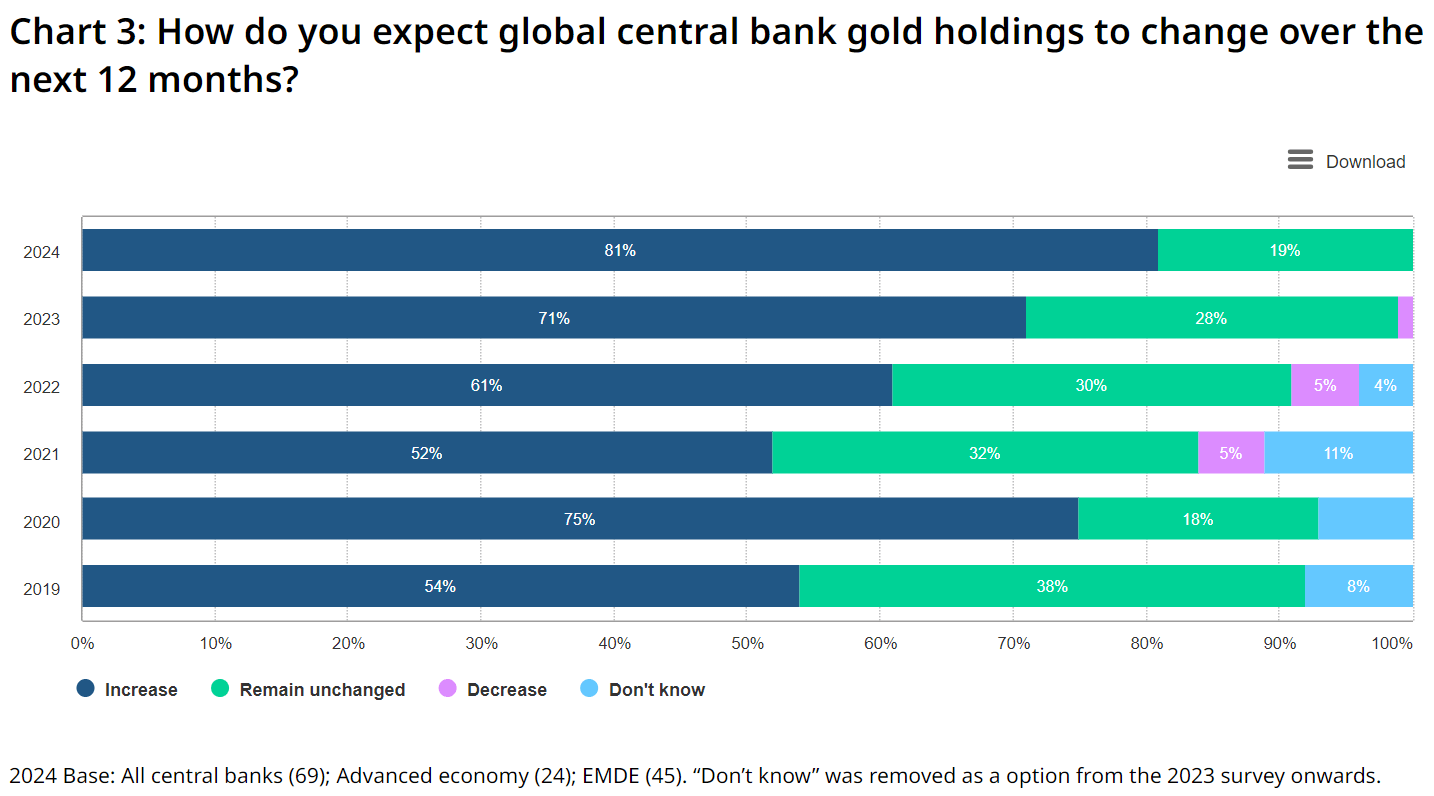

Perhaps one of the more telling findings from the World Gold Council’s annual survey is the broad expectation amongst central banks that gold holdings across the board are expected to rise over the next 12 months. 81% of respondents believe global central bank gold holdings will rise over the next year, a sign that current high prices may not deter banks for long.

The Fed has indicated that there will likely be one rate cut this year, potentially two as the dot plot revealed a narrow decision between the two anticipated outcomes. However, the first interest rate cut is only expected to arrive in Q4 according to markets, meaning the current decline in gold prices may show little urgency unless incoming US data deteriorates, bringing a rate cut forward in time which is likely to drive gold prices higher once again.

Gold is a non-yielding asset meaning investors tend to view it more favourably when interest rates are heading lower. Lower interest rates lowers the opportunity cost of holding gold and therefore makes it more attractive.

Source: WGC 2024

Gold Prices Give Very Little Away – Short and Medium-Term Trends Collide

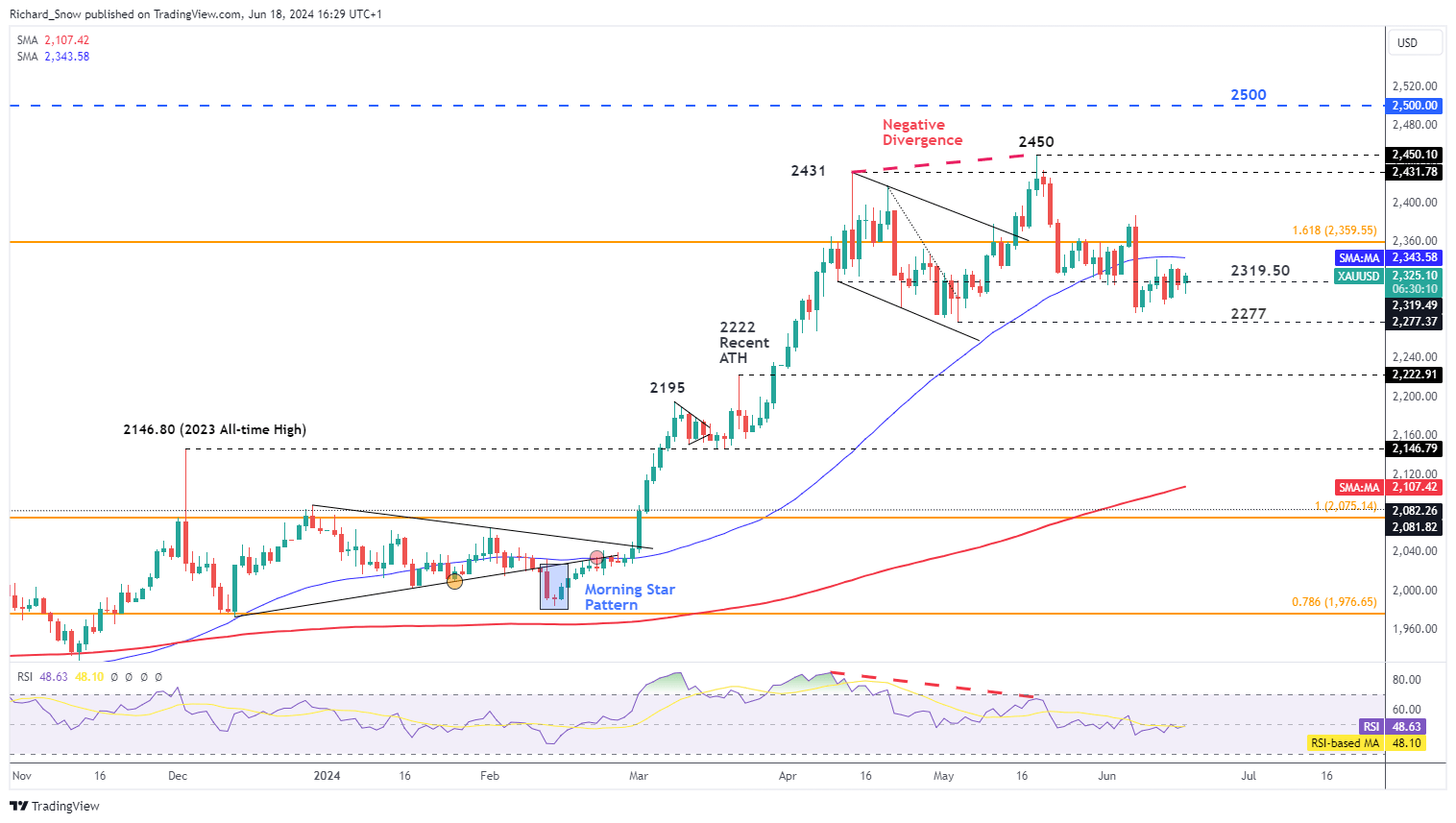

Gold prices have risen since the NFP low at the start of the month but the broader downtrend remains intact. Prices have headed lower, in a choppy fashion, since the all-time-high at $2,450 after negative divergence reared its head and hinted at a period of lower prices.

The downtrend developed as a series of lower lows and lower highs ensued – marking the recent low on Friday the 7th of June (NFP). Since then prices have attempted a comeback, rising above $2,320 but momentum has been lacking – evidenced by the narrowing pattern. If the blue 50 DMA holds as resistance, gold may adhere to the medium-term downtrend and head lower.

In recent times gold drivers have dissipated. There have been no notable escalations in either eastern Europe or the Middle East and US data has failed to provide a favourable environment for rate cuts. To the downside, gold bears will be eying the swing low at $2,287 and $2,287 which could act as a tripwire for an extended move lower.

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

Discover the power of crowd mentality. Download our free sentiment guide to decipher how shifts in gold's positioning can act as key indicators for upcoming price movements.

| Change in | Longs | Shorts | OI |

| Daily | 8% | -7% | 2% |

| Weekly | 12% | -18% | -1% |

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX