Japanese Yen, USD/JPY, US Dollar, Bank of Japan, Fed, Trend - Talking Points

- USD/JPY snapped lower and appears vulnerable to start the week

- The Bank of Japan might have a tricky period ahead on fundamental data

- If the Yen keeps strengthening, is the peak in place for USD/JPY?

USD/JPY remains under pressure at the start of this week after tumbling lower into the weekend in the wake of softer US CPI data.

The deceleration in price pressures has led to perceptions that the Fed may not have to raise rates as far next year as had previously been anticipated.

The easing in the CPI number didn’t change the swaps and futures markets pricing for the December Federal Open Market Committee (FOMC) meeting. Both markets are pricing in a 50 basis point hike.

Last week saw Japanese PPI remain at an elevated level, with mixed results in the data. The month-on-month figure for October was 0.6% rather than the 0.7% forecast and previously.

The year-on-year read was 9.1% instead of the 8.8% expected and 9.7% prior. The disparity is explained by an upward revision to previous months.

It is a big week ahead for Japanese data. GDP, industrial production, machine orders and national CPI reports lead the way from Tuesday onwards.

The inflation print could be especially crucial in light of the market reaction to US CPI and the implications for the Bank of Japan’s (BoJ) approach to monetary policy going forward.

The BoJ have a policy rate of -0.10% and are maintaining yield curve control (YCC) by targeting a band of +/- 0.25% around zero for Japanese Government Bonds (JGBs) out to 10-years.

According to a Bloomberg survey of economists, Japanese GDP is forecast to grow 0.3% in the third quarter compared with the prior three months, yielding a year-on-year figure of 1.2%. Both readings are seasonally adjusted.

This is against 3.7% year-on-year CPI anticipated for October, which illustrates the Japanese economy’s susceptibility to stagflation at this time.

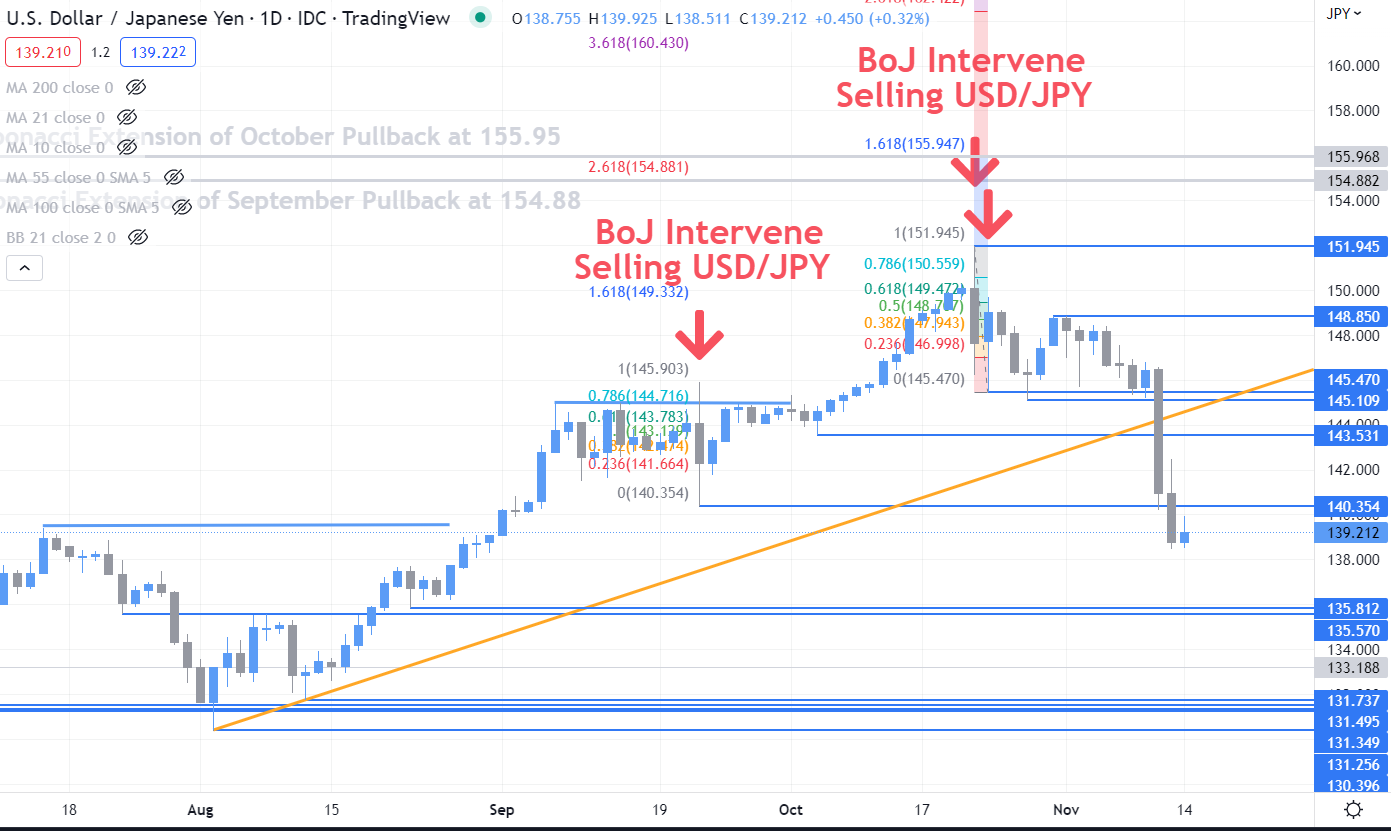

USD/JPY TECHNICAL ANALYSIS

USD/JPY broke below the lower bound of an ascending trend channel last week in an abrupt move that could signal the petering out of the bullish trend.

Previous support levels that have been broken might now offer breakpoint resistance at 140.35, 143.53, 145.11 and 145.47.

Support could be at the previous low and break point of 135.81 and 135.57 respectively.

{{EDU_SUBMODULE|15}}

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter